Vea también

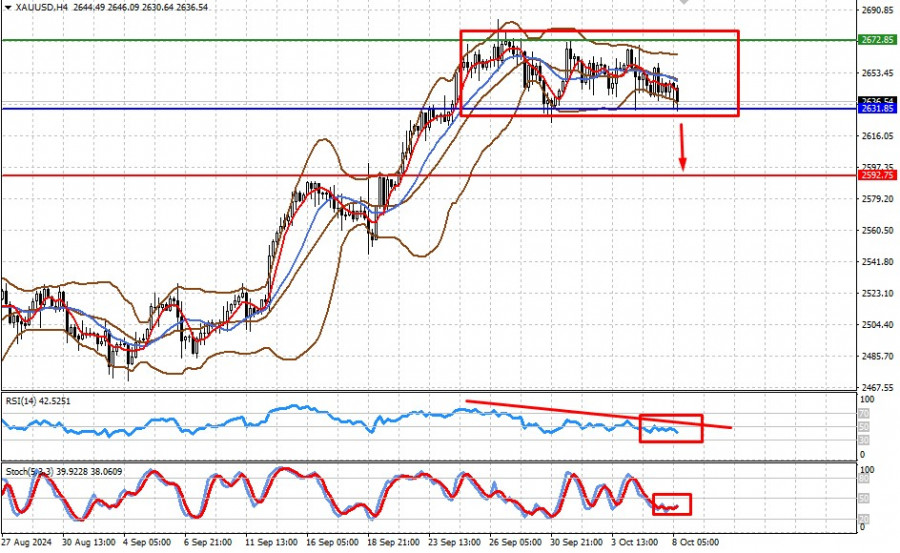

The "yellow metal" quotes continue to move within a narrow range of 2631.85-2672.85. A decrease in expectations for a more aggressive easing of the Federal Reserve's monetary policy could lead to a local correction in the gold market.

Gold is currently trading near the lower boundary of the range, and a breakout could trigger stop-loss orders and lead to further price declines. In the current situation, there seems to be a lack of interest—especially among central banks—in buying at these levels. The market's shift in focus from an aggressive Fed rate cut of 0.50% to 0.25% will put pressure on gold prices.

The price is at the lower line of the Bollinger Bands, below the SMA 5 and SMA 14. The RSI is below the 50% level and is pointing downward. Stochastics are currently uninformative.

A price drop below the support level of 2631.85 could lead to a decline toward 2592.75, corresponding to a 38% Fibonacci retracement.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.