Veja também

02.04.2025 08:50 AM

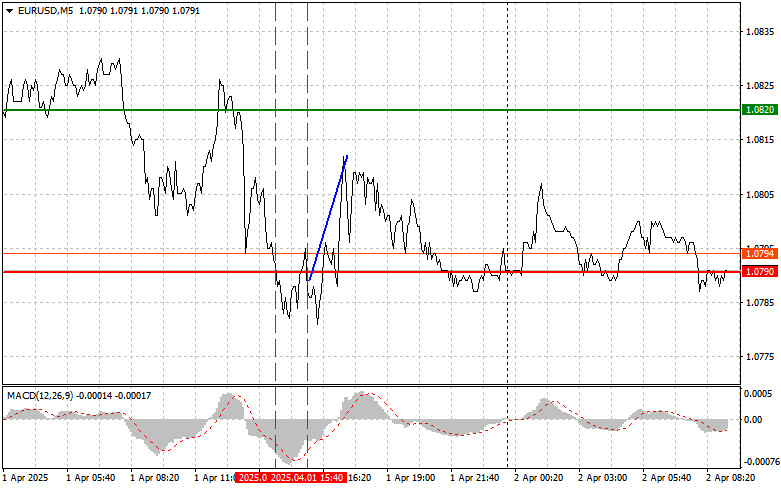

02.04.2025 08:50 AMThe price test at 1.0790 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside potential. For that reason, I did not sell the euro. A second test of 1.0790, with the MACD in the oversold zone, triggered Scenario #2 for buying the euro, which resulted in a 20-pip rise in the pair.

The euro did not react to yesterday's data on slowing inflation in the eurozone—neither rising nor falling—and remained within its current trading range. The published data showed that the core Consumer Price Index declined to 2.4% from 2.6%, outperforming analyst forecasts. Market participants chose to wait for further European Central Bank commentary on the matter to gain more clarity about the future of monetary policy.

No major macroeconomic releases are scheduled for the eurozone this morning, suggesting moderate trading activity. Investor attention will shift to the U.S. employment data and potential statements from Trump regarding tariffs, which could sharply increase pressure on risk assets, including the euro—so be prepared.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

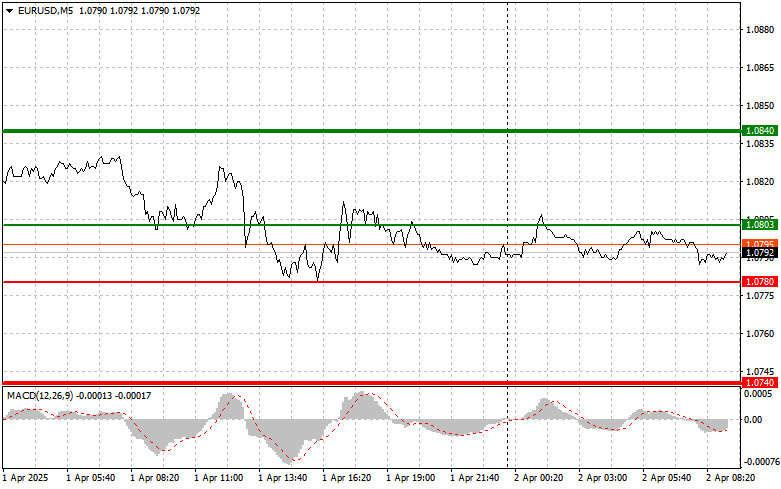

Scenario #1: I plan to buy the euro today at 1.0803 (green line on the chart), targeting a rise to 1.0840. At 1.0840, I plan to exit long positions and open short positions in the opposite direction, aiming for a 30–35 pip move from the entry. A bullish move in the euro in the first half of the day can only be expected as a minor correction. Important: Before buying, ensure that the MACD is above the zero line and beginning to rise.

Scenario #2: I will also consider buying the euro if there are two consecutive tests of 1.0780, with the MACD in oversold territory. This would limit the pair's downside potential and likely trigger a bullish reversal. Expect a rise toward 1.0803 and 1.0840.

Scenario #1: I plan to sell the euro after it reaches 1.0780 (red line on the chart), targeting a drop to 1.0740, where I will close short positions and enter long positions (expecting a 20–25 pip rebound). Pressure on the pair may return if there are unexpected tariff-related developments. Important: Before selling, ensure that the MACD is below the zero line and starting to decline.

Scenario #2: I will also consider selling the euro after two consecutive tests of 1.0803, provided the MACD is in the overbought zone. This would limit the pair's upside potential and trigger a bearish reversal. Expect a decline toward 1.0780 and 1.0740.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

O euro e a libra esterlina conseguiram resistir à renovada pressão vendedora, chegando até a recuperar parte de suas posições durante a sessão asiática desta quinta-feira. Na véspera, Donald Trump

O teste do nível de 147,13 ocorreu exatamente quando o indicador MACD começou a subir a partir da linha zero, confirmando um ponto de entrada válido para a compra

Análise das operações e dicas para a libra esterlina O teste de preço em 1,2882 ocorreu no momento em que o indicador MACD havia acabado de iniciar um movimento descendente

Análise e recomendações de negociação para o euro O teste de preço de 1,0975 ocorreu quando o indicador MACD tinha acabado de começar a se mover para baixo a partir

Notificações por

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.