Veja também

24.10.2022 09:44 AM

24.10.2022 09:44 AMRisk appetite surged after San Francisco Fed President Mary Daly said she wants to avoid an economic downturn caused by too-tight monetary policy. The news led to a strong growth of US stock indices, which is similar to what happened earlier, when Atlanta Fed President Raphael Bostic stated that he doubts the need to continue an aggressive rate hike. Such a reaction shows the desire of market players to buy risky assets after a sharp fall in the local stock market.

However, it is too early to be certain on the direction of the market as most of Fed representatives continue to declare the need to maintain the current course of active interest rate increases. Most likely, before the meeting of the central bank, markets will move without a specific direction, reacting to news and rumors about future actions on interest rates, as well as to the quarterly reports of companies.

So far, there is growing opinion that after a 75bp increase in November, the US central bank will start to reduce the pace of rate increases. This belief was strengthened further by the recent statement of Christopher Waller, which hinted that the increase in December may no longer be 0.75% or 0.50%. But again, a lot will depend on the behavior of inflation.

As for the dynamics today, trading on the stock markets in Europe may turn down, while dollar will grow against yen and other major currencies.

Forecasts for today:

EURUSD

The pair failed to overcome 0.9875. If it holds below it, expect a decline to 0.9750.

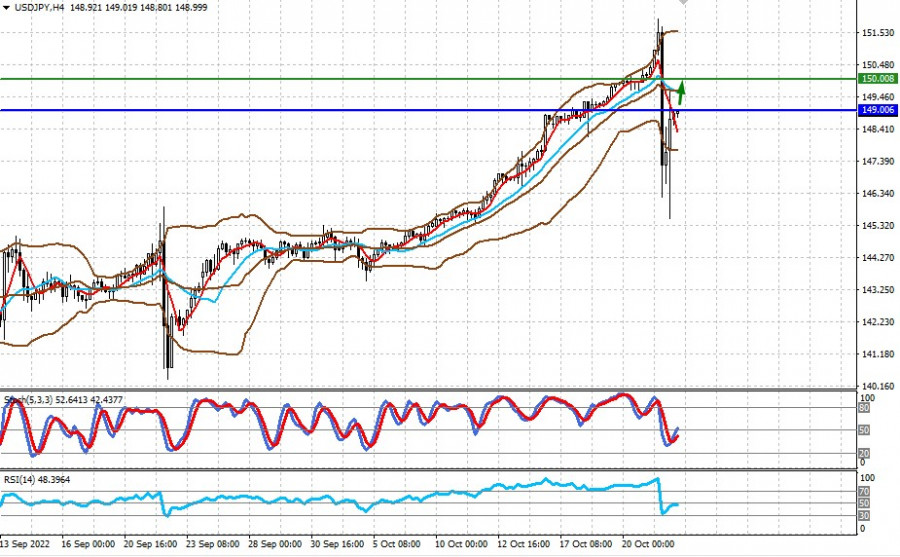

USD/JPY

The pair is actively recovering after a strong fall last Friday. Its rise and consolidation above 149.00 may lead to a growth to 150.00.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.