یہ بھی دیکھیں

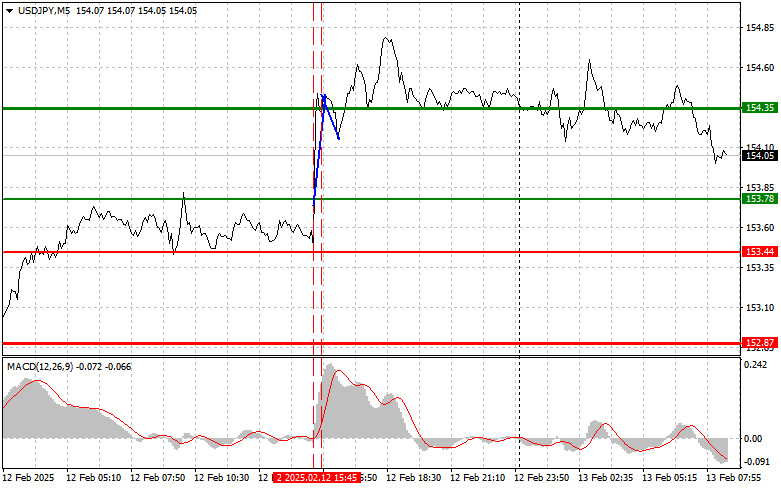

A test of the 153.78 price level occurred when the MACD indicator had just begun moving upward from the zero mark, confirming a valid buy entry for the U.S. dollar. As a result, the pair rose toward the target level of 154.35.

Today's data on the money supply aggregate and machinery orders led to a slight strengthening of the yen; however, this was not enough to counter yesterday's bullish momentum for the dollar. Market expectations ahead of the Bank of Japan's upcoming meeting also contributed positively, as many analysts believe the BoJ may continue its policy of interest rate hikes, which could strengthen the yen against the dollar.

In the short term, the movement of the USD/JPY pair will depend on several factors, including US macroeconomic data, statements from central bank representatives, and global investor sentiment.

For my intraday strategy, I will focus primarily on the outcomes of scenarios #1 and #2.

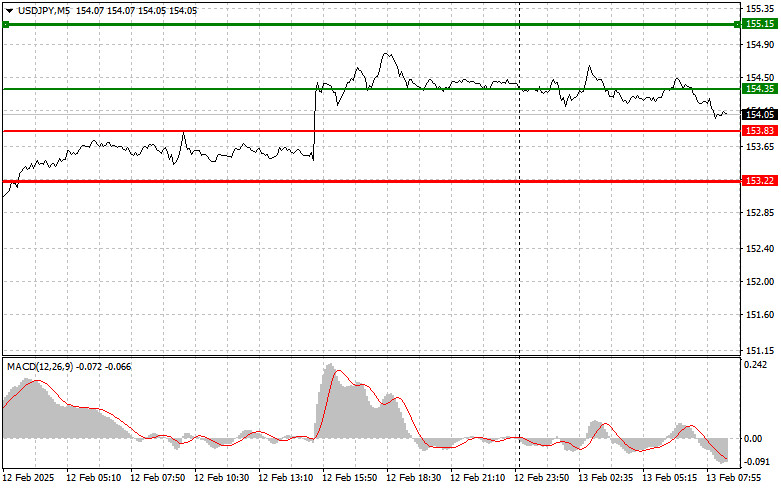

Scenario #1: I will consider buying USD/JPY today if the price reaches 154.35 (green line on the chart) with a target of 155.15 (thicker green line on the chart). At 155.15, I plan to exit long positions and initiate short trades, expecting a 30-35 pip downward move. Re-entering long positions is preferable on pullbacks and significant corrections in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I will also consider buying USD/JPY if the price tests 153.83 twice while the MACD indicator is in oversold territory. This will limit the pair's downside potential and trigger an upward market reversal. The expected target levels are 154.35 and 155.15.

Scenario #1: Selling USD/JPY will be considered only after breaking below the 153.83 level (red line on the chart), likely triggering a rapid decline in the pair. The key target for sellers will be 153.22, where I plan to exit short positions and immediately buy on a rebound (expecting a 20-25 pip upward move). Important! Before selling, ensure the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I will also consider selling USD/JPY if the price tests 154.35 twice while the MACD indicator is in overbought territory. This will cap the pair's upside potential and trigger a downward reversal. The expected downside targets are 153.83 and 153.22.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

انسٹا فاریکس کی طرف سے

فراری ایف 8 ٹریبوٹو

فاریکس چارٹ

ویب-ورژن

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.