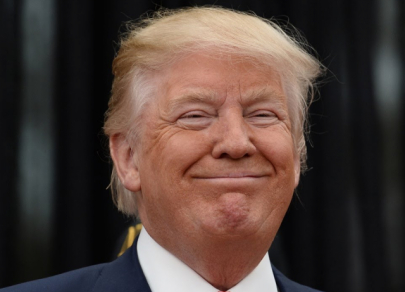

Personalities of 2024 according to Time

For nearly a century, the US-based weekly periodical Time has closed out the year by selecting the person who has had the most significant impact on the global stage—not necessarily a positive one. This year, the magazine's cover features Donald Trump, who recently won the US presidential election. Let's find out who else was honored by Time and in which nimonations.