Lihat juga

31.03.2025 09:35 AM

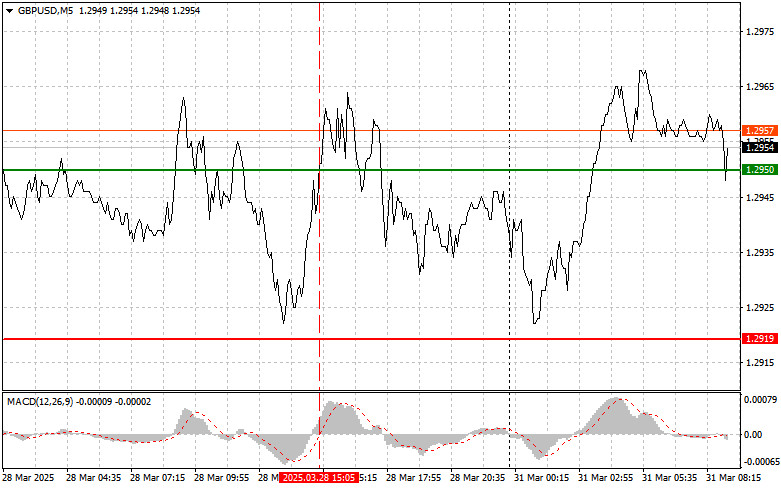

31.03.2025 09:35 AMThe price test at 1.2950 occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I didn't buy the pound and stayed out of trades in the second half of the day.

After positive GDP data, the pound regained some strength at the end of last week, which helped limit the pair's downside potential. Weak U.S. data also helped traders ease the pressure. Unfortunately, UK GDP in the first quarter is expected to show even more modest growth, which may pressure the pound. Declining inflation—a key factor shaping the Bank of England's dovish monetary policy—supports this view.

Today during the European session, the UK will publish data on the number of mortgage approvals, net lending to individuals, and the change in the M4 money supply aggregate. While these figures help gauge the domestic health of the British economy, they are unlikely to significantly impact overall FX market dynamics, including the pound. Investors will likely focus on more significant macroeconomic drivers such as inflation, interest rates, and the geopolitical landscape.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.2965 (green line on the chart), targeting a rise to 1.3018 (thicker green line). Around 1.3018, I plan to exit long positions and open shorts in the opposite direction (expecting a move of 30–35 pips in the opposite direction). Pound growth should only be expected after strong economic data. Important: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the pound today if the price tests 1.2935 twice consecutively while MACD is in oversold territory. This would limit the pair's downside potential and trigger a reversal to the upside. A rise toward the opposite levels, 1.2965 and 1.3018, may be expected.

Scenario #1: I plan to sell the pound today after breaking below 1.2935 (red line on the chart), which would lead to a quick decline. The key target for sellers will be 1.2885, where I intend to exit short positions and open long positions in the opposite direction (expecting a 20–25 pip bounce). Selling the pound is best done from higher levels. Important: Before selling, ensure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of 1.2965 while MACD is in overbought territory. This would limit the pair's upside potential and trigger a downward reversal. A decline toward the opposite levels, 1.2935 and 1.2885, may be expected.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Analisis Dagangan dan Petua Dagangan untuk Yen Jepun Ujian harga pada paras 142.60 berlaku ketika penunjuk MACD telah bergerak jauh di atas paras sifar, yang pada pandangan saya telah mengehadkan

Analisis Dagangan dan Petua Dagangan untuk Pound British Ujian harga pada paras 1.3322 berlaku apabila penunjuk MACD telah bergerak jauh di atas garisan sifar, sekali gus mengehadkan potensi kenaikan pasangan

Analisis Dagangan dan Petua Dagangan untuk Euro Ujian pertama pada aras harga 1.1372 pada separuh kedua hari berlaku apabila penunjuk MACD sudah pun bergerak jauh di bawah paras sifar, yang

EUR dan GBP berjaya bertahan daripada tekanan semalam, namun hari ini penurunan dalam aset berisiko yang digandingkan dengan dolar terus berlanjutan. Data yang diterbitkan mengenai pasaran buruh AS serta angka

Analisis Perdagangan dan Tip Strategi untuk Yen Jepun Ujian pertama pada tahap 142.66 berlaku apabila penunjuk MACD telah jatuh dengan ketara di bawah garisan sifar, yang menghadkan potensi penurunan pasangan

Analisis Dagangan dan Tip Berdagang Pound Britain Ujian pada tahap 1.3286 berlaku apabila penunjuk MACD sudah bergerak jauh melepasi paras sifar, yang pada pendapat saya, mengehadkan potensi kenaikan pound. Oleh

Ulasan Perdagangan dan Tip untuk Berdagang Euro Ujian bagi tahap 1.1361 berlaku apabila penunjuk MACD telah bergerak jauh di atas paras sifar, yang mengehadkan potensi kenaikan bagi pasangan mata wang

Analisis Dagangan dan Petua Dagangan untuk Yen Jepun Ujian pada paras 142.32 berlaku apabila penunjuk MACD telah pun bergerak jauh melepasi paras sifar, yang pada pandangan saya, telah mengehadkan potensi

Analisis Dagangan dan Petua Dagangan untuk Euro Ujian harga pada paras 1.1382 pada separuh kedua hari ini bertepatan dengan penunjuk MACD yang mula bergerak ke bawah dari garis sifar, sekali

Analisis Dagangan dan Petua Dagangan untuk Pound British Ujian harga pada paras 1.3285 berlaku apabila penunjuk MACD baru sahaja mula bergerak menurun dari paras sifar, sekali gus mengesahkan titik masuk

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.