Lihat juga

31.01.2025 01:48 PM

31.01.2025 01:48 PMToday, NZD/USD is attracting buyers, breaking a three-day losing streak. However, its upward potential appears limited.

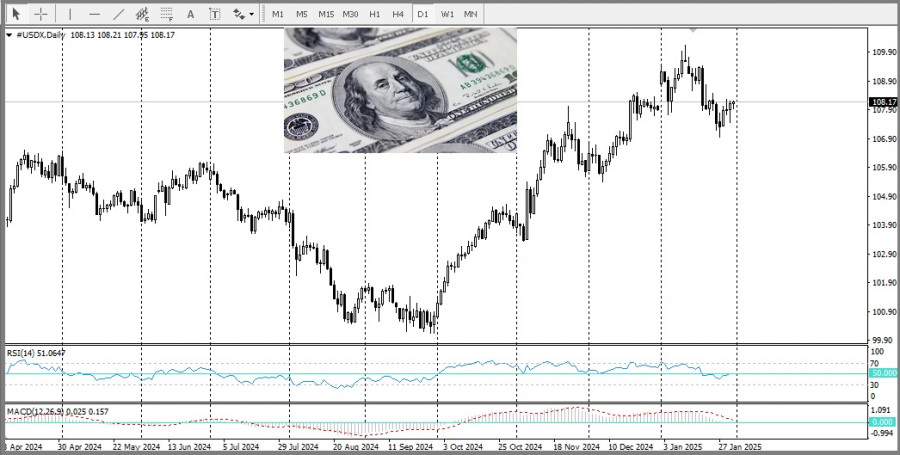

A generally positive tone in equity markets is preventing a stronger U.S. dollar recovery from its more than one-month low, which supports the risk-sensitive New Zealand dollar. However, the current rebound lacks a clear fundamental catalyst and may fade quickly amid prevailing bearish sentiment.

The Federal Reserve's hawkish pause on Wednesday contrasts sharply with the more aggressive policy easing by the Reserve Bank of New Zealand (RBNZ), warranting caution before opening new bullish positions in NZD/USD. Persistent concerns over Trump's administration's protectionist trade tariffs further add to the uncertainty.

Additionally, expectations that Trump's policies could drive inflation higher have contributed to a modest rebound in U.S. Treasury yields, which supports the U.S. dollar. As a result, the NZD/USD pair may face resistance ahead of the U.S. Core PCE Price Index release.

Neutral oscillators suggest caution before initiating new long positions. Moreover, the 14-day EMA and 9-day EMA merging into a single line indicate a sideways price movement, reinforcing the outlook for a range-bound market in the near term.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Euro tidak banyak memberi reaksi, manakala pound sedikit melemah berbanding dolar AS selepas ucapan Pengerusi Rizab PersekutuanJerome Powell semalam. Menurut Powell, Fed kini memberi tumpuan kepada dwi-mandat yang ditetapkan oleh

Jika anda percaya kemelesetan ekonomi menghampiri, peraturannya mudah: jual dahulu, tanya kemudian. Apabila Biro Penyelidikan Ekonomi Nasional secara rasmi mengisytiharkan kemelesetan di Amerika Syarikat pada Disember 2008, S&P 500 menjunam

Minggu ini, Kesatuan Eropah dan Amerika Syarikat tidak mencapai kemajuan yang signifikan dalam menyelesaikan pertikaian perdagangan, kerana pegawai dari pentadbiran Presiden Donald Trump menunjukkan bahawa kebanyakan tarif yang dikenakan oleh

Emas terus menarik perhatian pelabur, terutamanya dalam tempoh ketidaktentuan yang tinggi di pasaran kewangan. Ketidaktentuan Perdagangan: Ketidaktentuan yang berterusan dalam hubungan perdagangan antara AS dan China menjadikan emas sebagai aset

Optimisme pasaran, yang didorong oleh manipulasi naratif tarif secara aktif oleh Donald Trump, tidak bertahan lama. Pedagang tetap memberi tumpuan kepada ketegangan yang semakin meningkat antara A.S. dan China selepas

InstaTrade

Akaun PAMM

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.