Lihat juga

09.01.2024 02:39 PM

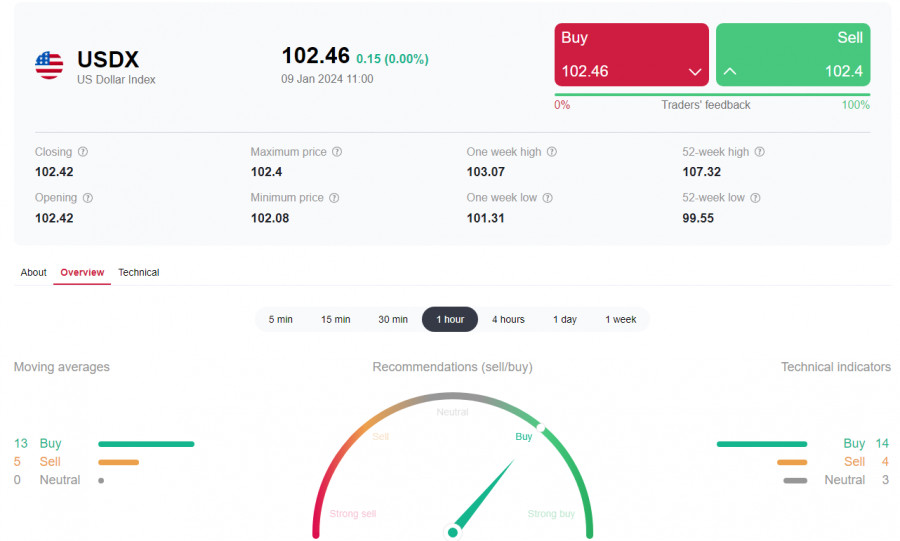

09.01.2024 02:39 PMThe dollar remains stable ahead of the key publications on Thursday, although the growth of its DXY index has also paused near the levels of 102.00, 102.10. The sluggish dynamics in the currency market and range-bound trading may continue until these publications on Thursday.

Clearly, the market and the dollar need new drivers, which could be provided by fresh data on inflation in the USA, to be published on Thursday.

From a technical point of view, the dollar index (CFD #USDX in the MT4 terminal) is trying to revive the long-term upward dynamics, having rebounded at the end of December from the key long-term support level of 100.55 (200 EMA on the weekly chart) and breaking into the zone above the important long-term support level of 101.70 (144 EMA on the weekly chart).

The breakout of the recent local high of 102.70 and the important short-term resistance level of 102.83 (200 EMA on the 4-hour chart) may signal the accumulation of long positions on the dollar index and CFD #USDX.

In case of further growth, the breakout of the key medium-term resistance level of 103.80 (200 EMA, 144 EMA on the daily chart) will confirm the entry of the dollar index into the medium-term bull market zone.

An alternative scenario will be associated with the breakdown of the key long-term support level of 100.55. Further decline and break below the 100.00 mark will move DXY into the zone of a long-term bear market, making long-term short positions preferable from a technical point of view.

The earliest signal for the start of implementing this scenario may be the breakdown of the short-term support level of 102.13 (200 EMA on the 1-hour chart) and the 102.00 mark, and the breakdown of the important support level of 101.70 as confirmation.

Support levels: 102.13, 102.00, 101.70, 101.00, 100.55, 100.00

Resistance levels: 102.70, 102.83, 103.00, 103.20, 103.80, 104.00

Trading Scenarios

Main scenario: Buy at market, Buy Stop 102.85. Stop-Loss 101.90. Targets 103.00, 103.30, 103.70, 103.85, 104.00, 105.00, 105.98, 106.00, 106.80, 107.00, 107.09, 107.32, 107.80, 108.00, 109.00, 109.25

Alternative scenario: Sell Stop 101.90. Stop-Loss 102.50. Targets 101.70, 101.00, 100.55, 100.00

'Targets' correspond to support/resistance levels. This does not mean that they will necessarily be reached, but can serve as a guide when planning and placing your trading positions.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.