Lihat juga

12.10.2023 02:55 PM

12.10.2023 02:55 PMThe market has ignored the rise in U.S. producer inflation and the hawkish stance of the Fed officials regarding the prospects of monetary policy.

As indicated by the data published on Wednesday, the annual Producer Price Index (PPI) of American producers accelerated in September from 2.0% (revised from 1.6% in August) to 2.2% (against a forecast of 1.6%).

The annual core PPI (excluding food and energy) also increased in September to 2.7% (from 2.5% in August, with a forecast of 2.3%).

At the same time, most members of the Federal Open Market Committee (FOMC) consider another rate hike this year to be the most likely scenario, although much will depend on incoming data, particularly from the labor market, GDP dynamics, and inflation data. The minutes from the September Fed meeting, published on Wednesday, confirmed that monetary policy should remain "sufficiently restrictive" for some time to bring inflation back to the 2% level.

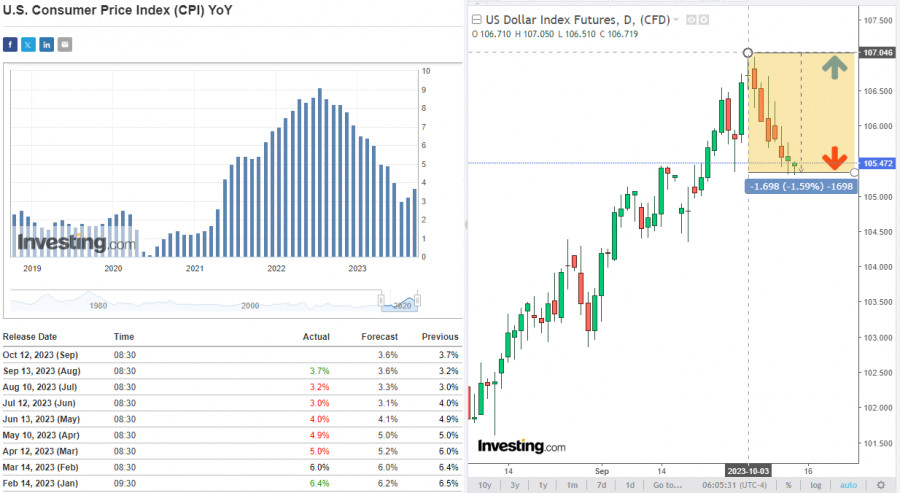

On Wednesday, the U.S. Dollar Index (DXY) remained at the previous day's closing level, near 105.56. As of writing, DXY was nine points below this level, while investors, for the most part, maintained a cautious trading position ahead of the release of the September statistics on U.S. consumer inflation (at 12:30 GMT). Here, a slowdown in the Consumer Price Index (CPI) to 0.3% (from 0.6% in August) and 3.6% in annual terms (compared to the previous 3.7%) is expected. The annual core CPI may also decrease in September to 4.1% from 4.3% the previous month.

These forecasts are holding back dollar buyers and the dollar itself from a more pronounced recovery after a recent correction. If these forecasts materialize, the likelihood of another interest rate hike in the U.S. will decrease.

Nonetheless, there is still a chance that inflation indicators will exceed expectations, considering the data on rising producer prices published Wednesday, which is also keeping the dollar from further weakening today.

The rise in inflation in the U.S. will compel Fed officials to adhere to their main scenario—keeping the interest rate at high levels for an extended period, at least until the middle of next year, as some economists believe, increasing the probability of another interest rate hike by the end of the year.

Meanwhile, market participants monitoring the dynamics of the British pound have paid attention to the publication of data on the UK GDP and industrial production (at 06:00 GMT). In August, the country's GDP increased by 0.2%, following a decline of 0.6% (revised from 0.5%) in July. However, industrial production volumes decreased by 0.7% in August, after a 1.1% decline (revised from 0.7%) in July. In annual terms, industrial production volumes increased in August, but fell short of the forecast (1.3% against a forecast of 1.7%, following a 1.0% increase in July).

In response to this publication, the pound weakened against the dollar and major cross pairs.

The GBP/USD pair, in particular, lost 28 pips immediately after the data was published, dropping below the 1.2300 level. If the decline accelerates today, likely after the release of U.S. CPI and in the case of higher figures, a break below the support levels at 1.2280 and 1.2269 would be the first signal for resuming short positions, with a break of the important short-term support level at 1.2232 confirming it.

The GBP/USD pair rose at the end of last week and the beginning of this week. However, this can largely be attributed to the weakening of the dollar rather than pound strength.

The pair remains in the zone of medium-term and long-term bearish trends, below the key levels of 1.2440 and 1.2770, respectively. Therefore, signs of dollar strength will trigger a resumption of the GBP/USD downward trend.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Dolar A.S. mengukuh berbanding sejumlah mata wang global, begitu juga pasaran saham A.S., selepas laporan bahawa kerajaan China sedang mempertimbangkan untuk menggantung tarif 125% terhadap beberapa jenis import A.S. Langkah

Permulaan rundingan sebenar boleh menyebabkan penurunan ketara dalam harga emas dalam masa terdekat. Dalam artikel-artikel terdahulu, saya mencadangkan bahawa harga emas yang sebelum ini meningkat dengan ketara boleh mengalami pembetulan

Pada hari Khamis, pasangan mata wang GBP/USD diniagakan lebih tinggi, kekal berhampiran paras tertinggi 3 tahun. Walaupun pound British menaik kukuh dalam beberapa bulan kebelakangan ini, pembetulan masih jarang berlaku

Pasangan mata wang EUR/USD meneruskan dagangan secara tenang pada hari Khamis, meskipun tahap volatiliti kekal agak tinggi. Minggu ini, dolar AS menunjukkan beberapa tanda pemulihan—sesuatu yang boleh dianggap sebagai satu

Analisis Laporan Makroekonomi: Beberapa acara makroekonomi dijadualkan pada hari Jumaat, tetapi ini tidak penting, memandangkan pasaran terus mengabaikan 90% daripada semua penerbitan. Antara laporan yang lebih atau kurang signifikan hari

Minggu lalu, Bank of Canada mengekalkan kadar faedah tidak berubah pada paras 2.75%, seperti yang dijangkakan. Kenyataan yang dikeluarkan bersama keputusan tersebut bersifat neutral, menekankan ketidaktentuan yang berterusan. Sukar untuk

Presiden Amerika Syarikat, Donald Trump sekali lagi memberikan komen mengenai Pengerusi Rizab Persekutuan, Jerome Powell, secara terbuka menyatakan rasa tidak puas hati dengan kadar pemotongan kadar faedah. Satu lagi ungkapan

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.