#INDU (Dow Jones Industrial Average). Exchange rate and online charts.

Currency converter

02 Apr 2025 02:44

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The Dow Jones Industrial Average was created by Wall Street Journal editor and Dow Jones & Company co-founder Charles Dow.

In 1884, Charles Dow compiled a list of nine railroad and two industrial stocks and divided their prices by 11 to produce a stock market average.

The 12-stock industrial average was introduced in 1896. The first day's stock average was 69.93 (total value of its constituent shares at that time was 769.23). In 1928, the index was expanded to include 30 stocks and has remained at 30 industrials since then.

While many of the stocks within the Dow no longer represent industrial companies, the name “Industrial Average” remains.

The New York Stock Exchange (NYSE) updates the Dow Jones every half hour throughout a trading day.

According to analysts, the Dow Jones Industrial Average index can offer good trading opportunities. Its moderate volatility makes the CFD on this index a great instrument for long-term and patient investors.

See Also

- The Japanese yen lacks clear intraday direction as traders await Trump's retaliatory tariffs

Author: Irina Yanina

11:37 2025-04-01 UTC+2

1003

Type of analysisUSDJPY: Simple Trading Tips for Beginner Traders on April 1 – Review of Yesterday's Forex Trades

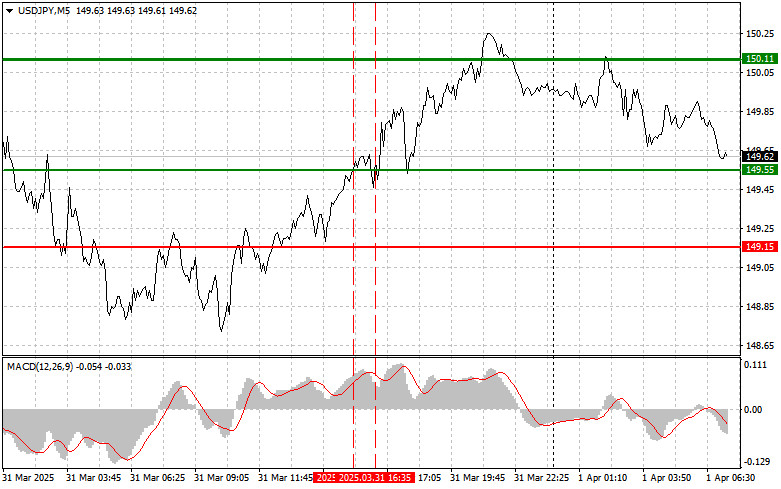

USDJPY: Simple Trading Tips for Beginner Traders on April 1 – Review of Yesterday's Forex TradesAuthor: Jakub Novak

10:58 2025-04-01 UTC+2

943

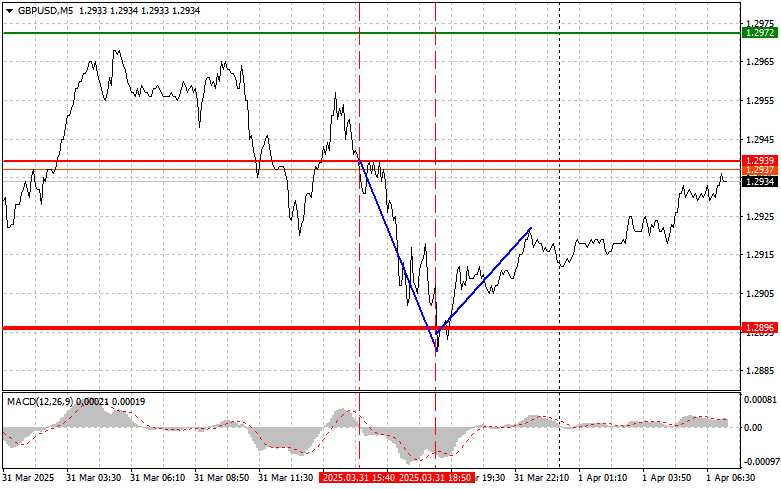

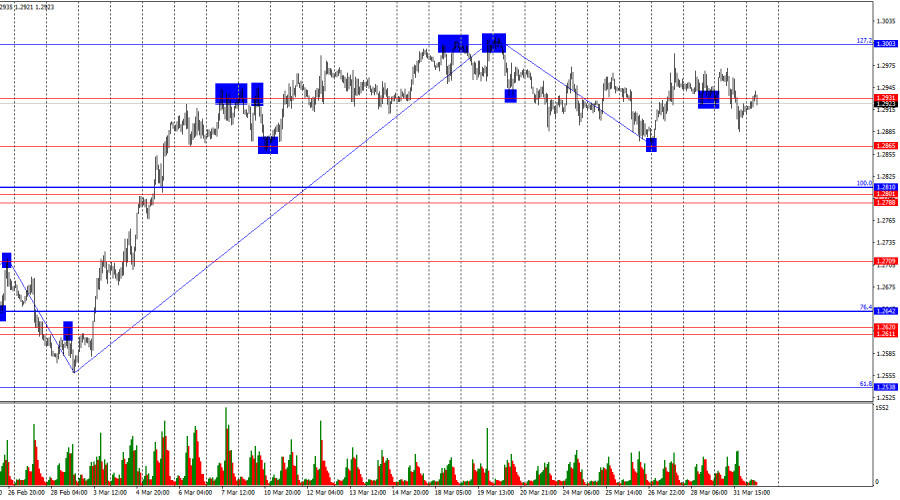

GBP/USD: Simple Trading Tips for Beginner Traders on April 1 – Forex Trade ReviewAuthor: Jakub Novak

10:55 2025-04-01 UTC+2

913

- The current panic in the markets may be overblown. If tomorrow's tariffs prove to be less damaging than expected, we could witness a short but sharp rebound, particularly in the S&P 500.

Author: Natalya Andreeva

11:03 2025-04-01 UTC+2

913

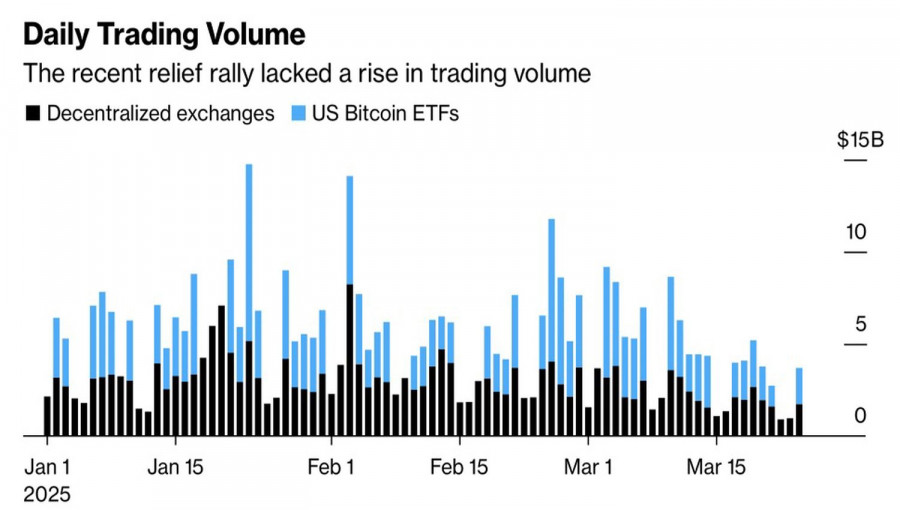

Even smart money stays cautious, holding back from building long BTC/USD positionsAuthor: Marek Petkovich

15:58 2025-04-01 UTC+2

913

Technical analysis / Video analyticsForex forecast 01/04/2025: EUR/USD, AUD/USD, NZD/USD, SP500 and Bitcoin

Technical analysis of EUR/USD, AUD/USD, NZD/USD, SP500 and BitcoinAuthor: Sebastian Seliga

11:43 2025-04-01 UTC+2

898

- Bears still can't show anything

Author: Samir Klishi

11:29 2025-04-01 UTC+2

898

Technical analysisTrading Signals for GOLD (XAU/USD) for April 1-3, 2025: sell below $3,144 (21 SMA - 8/8 Murray)

On the other hand, if the price consolidates below the 8/8 Murray level at 3,125, the outlook will be negative. So, we believe the instrument could reach 3,091 in the short term and eventually climb to the 7/8 Murray level at 3,046.Author: Dimitrios Zappas

15:04 2025-04-01 UTC+2

883

Bulls tried to advance, but Trump put a stop to itAuthor: Samir Klishi

11:32 2025-04-01 UTC+2

853

- The Japanese yen lacks clear intraday direction as traders await Trump's retaliatory tariffs

Author: Irina Yanina

11:37 2025-04-01 UTC+2

1003

- Type of analysis

USDJPY: Simple Trading Tips for Beginner Traders on April 1 – Review of Yesterday's Forex Trades

USDJPY: Simple Trading Tips for Beginner Traders on April 1 – Review of Yesterday's Forex TradesAuthor: Jakub Novak

10:58 2025-04-01 UTC+2

943

- GBP/USD: Simple Trading Tips for Beginner Traders on April 1 – Forex Trade Review

Author: Jakub Novak

10:55 2025-04-01 UTC+2

913

- The current panic in the markets may be overblown. If tomorrow's tariffs prove to be less damaging than expected, we could witness a short but sharp rebound, particularly in the S&P 500.

Author: Natalya Andreeva

11:03 2025-04-01 UTC+2

913

- Even smart money stays cautious, holding back from building long BTC/USD positions

Author: Marek Petkovich

15:58 2025-04-01 UTC+2

913

- Technical analysis / Video analytics

Forex forecast 01/04/2025: EUR/USD, AUD/USD, NZD/USD, SP500 and Bitcoin

Technical analysis of EUR/USD, AUD/USD, NZD/USD, SP500 and BitcoinAuthor: Sebastian Seliga

11:43 2025-04-01 UTC+2

898

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 1-3, 2025: sell below $3,144 (21 SMA - 8/8 Murray)

On the other hand, if the price consolidates below the 8/8 Murray level at 3,125, the outlook will be negative. So, we believe the instrument could reach 3,091 in the short term and eventually climb to the 7/8 Murray level at 3,046.Author: Dimitrios Zappas

15:04 2025-04-01 UTC+2

883

- Bulls tried to advance, but Trump put a stop to it

Author: Samir Klishi

11:32 2025-04-01 UTC+2

853