यह भी देखें

The currency market is gradually "moving away" from Powell's unexpected "hawkishness" and the strong U.S. employment data. Yesterday, the dollar index fell by 0.03%, and the market probability of a 0.25% rate cut in November decreased from 93% to 81%, while the likelihood of maintaining the rate unchanged increased from 7% to 19%. The yield on 5-year U.S. government bonds rose to 3.88% yesterday and is now at 3.84% this morning.

Despite the stock market dropping by 0.96% (S&P 500) yesterday, the dollar now faces a new reason for the decline—the approaching Hurricane "Milton," a Category 5 storm (the highest level) expected to reach Florida's coast by Wednesday. Evacuations have been declared in most counties of the state.

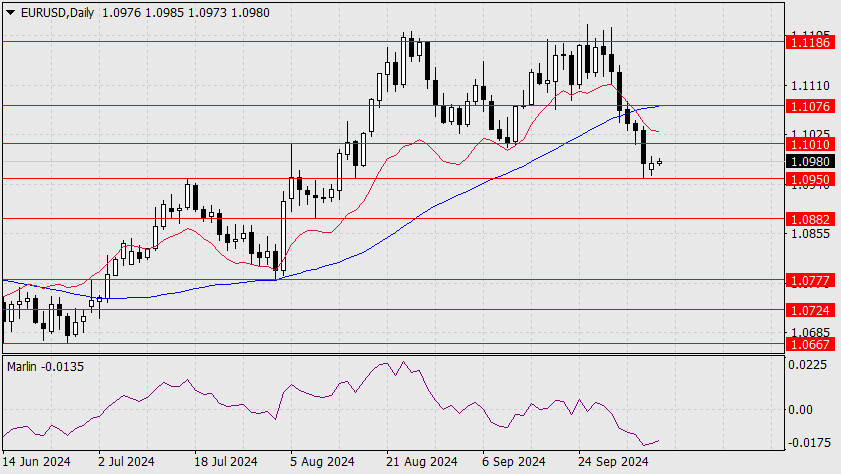

We anticipate further euro growth, with a breakthrough above the 1.1010 resistance and a subsequent target level of 1.1076. Consolidation above this level will open the next target at 1.1186.

On the four-hour chart, the Marlin oscillator is rising ahead of the price. This may indicate that it is pulling the price above the nearest resistance, though a corrective pullback from the 1.1076 level is possible since Marlin will likely enter the overbought zone by then.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |