Lihat juga

07.04.2025 06:57 AM

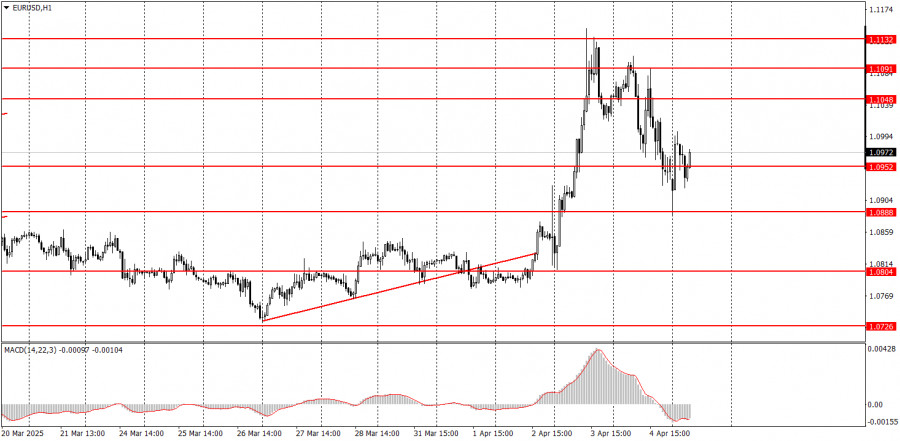

07.04.2025 06:57 AMThe EUR/USD currency pair remained in stormy conditions on Friday. This time, a downward movement prevailed—but that didn't make things any easier. It wouldn't have been surprising if we had seen another dollar collapse on Friday. The market is in a state of panic due to global events. The U.S. stock market is plunging, Bitcoin is crashing, and the U.S. dollar has consistently fallen throughout Donald Trump's presidency. There's no point in discussing logical, technical, or consistent movements right now. On Friday, the dollar continued to decline overnight due to Trump's new tariffs. During the European session, it began to recover sharply. By the start of the U.S. session, it dropped heavily again and rebounded strongly again. Of all these moves, the American session's activity was relatively logical, as the Nonfarm Payrolls report exceeded forecasts and Jerome Powell once again adopted a hawkish stance.

In the 5-minute timeframe, many trading signals were generated on Friday. Novice traders could have opened trades nearly every hour. We don't believe such volatile movements should be traded—especially when the market is panicking and behaving emotionally. Just count how many times the price reversed during the day—and it was a substantial move each time.

The EUR/USD pair continues its upward trend in the hourly timeframe. It is uncertain how long this situation will continue, as no one can predict how many additional tariffs Trump may impose. Multiple escalations in the trade war are possible as many countries prepare to respond to the U.S. with reciprocal measures. And Trump has already declared that any countermeasures will trigger further tariffs from the U.S.

On Monday, markets will likely remain in a state of shock. We refrain from forecasting any movements. Describing the current situation across all markets is quite challenging.

On the 5-minute chart, consider the following levels: 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, 1.1048, 1.1091, 1.1132–1.1140, 1.1189–1.1191, 1.1275–1.1292.

The only relatively important releases for Monday will be retail sales in the Eurozone and industrial production in Germany. However, considering last week's developments and the ongoing market panic, it is unlikely these reports will significantly impact the pair's movement.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Rabu, pasangan GBP/USD mengikuti pergerakan pasangan EUR/USD dengan cermat, semakin mengonfirmasi bahwa situasi saat ini bergantung pada dolar AS. Nasib dolar AS sepenuhnya bergantung pada kehendak Donald Trump

Pada hari Rabu, pasangan mata uang EUR/USD diperdagangkan dengan cara yang bervariasi. Sepanjang hari, harga beberapa kali berubah arah, dan data makroekonomi tidak memicu perubahan ini. Pasar tetap dalam keadaan

Pada hari Rabu, pasangan mata uang GBP/USD mengikuti tren yang sama dengan pasangan EUR/USD. Pound Inggris semalam juga anjlok setelah dua pernyataan dari Donald Trump, kemudian dengan cepat pulih, hanya

Pada hari Rabu, pasangan mata uang EUR/USD trading dalam kedua arah, terus-menerus mengubah trajektorinya. Hari trading dimulai dengan penurunan harga setelah pengumuman Donald Trump bahwa dia tidak akan memecat Jerome

Dalam prediksi pagi saya, saya menyoroti level 1,3304 dan merencanakan untuk membuat keputusan masuk pasar dari level tersebut. Mari kita lihat grafik 5-menit dan menganalisis apa yang terjadi. Kenaikan

Dalam prediksi pagi, saya menyoroti level 1.,1412 dan merencanakan untuk membuat keputusan trading dari sana. Mari perhatikan grafik 5 menit dan analisis apa yang terjadi. Kenaikan dan pembentukan false breakout

Pada hari Selasa, pasangan GBP/USD mengalami penurunan yang cukup signifikan. Meskipun penurunan pound dimulai dengan agak lambat, pada malam harinya, Donald Trump akhirnya memutuskan untuk membantu dolar AS. Presiden

Pada hari Selasa, pasangan mata uang EUR/USD menunjukkan penurunan yang cukup signifikan. Kuotasi euro turun hampir sepanjang hari, dengan pergerakan yang semakin intensif pada malam hari. Penurunan ini semakin cepat

Pada hari Selasa, pasangan mata uang GBP/USD menunjukkan volatilitas yang sangat rendah dan kurangnya minat dalam trading secara umum. Sementara euro diperdagangkan dengan penurunan, pound Inggris sebagian besar tetap diam

Pada hari Selasa, pasangan mata uang EUR/USD trading lebih rendah. Sekali lagi, volatilitas jauh dari rendah, yang mungkin menunjukkan adanya peristiwa atau berita penting pada hari itu. Namun, tidak

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.