Lihat juga

04.04.2025 08:00 AM

04.04.2025 08:00 AMThe euro and the pound are once again in demand, while the U.S. dollar is under heavy pressure. I believe the reason behind this is apparent, although few likely expected such a breakout in risk assets on the currency market.

Yesterday, the euro and the pound posted substantial gains amid a broad weakening of the U.S. dollar following the introduction of trade tariffs by Donald Trump. The dollar's decline was tied to a downward revision in growth forecasts for the U.S. economy. Meanwhile, the euro's strength was supported by upbeat PMI data from eurozone countries, indicating a recovery in the region's economy. This boosted expectations for the European Central Bank to slow its active rate-cutting cycle. However, some traders believe the rally is temporary and simply a negative market reaction to Trump's policies, while others argue that the euro has room to strengthen further if eurozone economic performance continues to improve.

This morning, data on German industrial orders and a series of reports from Italy are expected. Investors will also be paying close attention to updates from the U.S. labor market.

Positive economic readings from Germany and Italy will create additional tailwinds for the euro. On the other hand, weaker data could trigger a correction. The UK will also publish its construction PMI, which could further support pound strength.

If data aligns with economist expectations, the Mean Reversion strategy is preferable. If data deviates significantly from forecasts, a Momentum strategy is preferred.

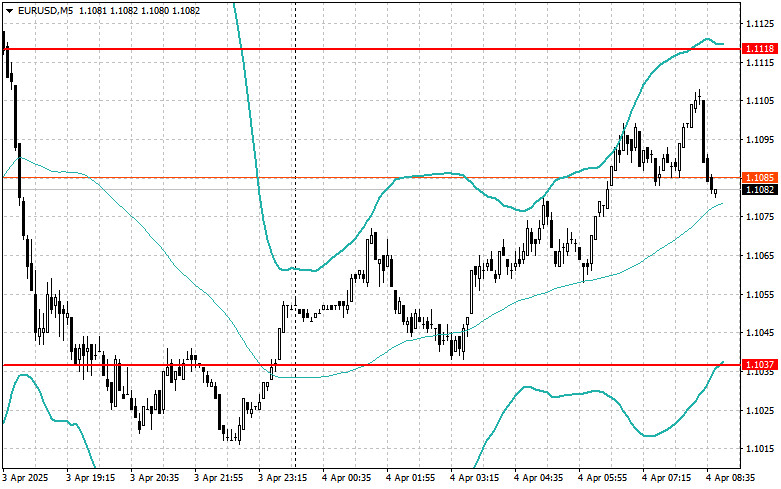

Buying on a breakout above 1.1097 may lead to a rise toward 1.1143 and 1.1179.

Selling on a breakout below 1.1039 may lead to a decline toward 1.0994 and 1.0946.

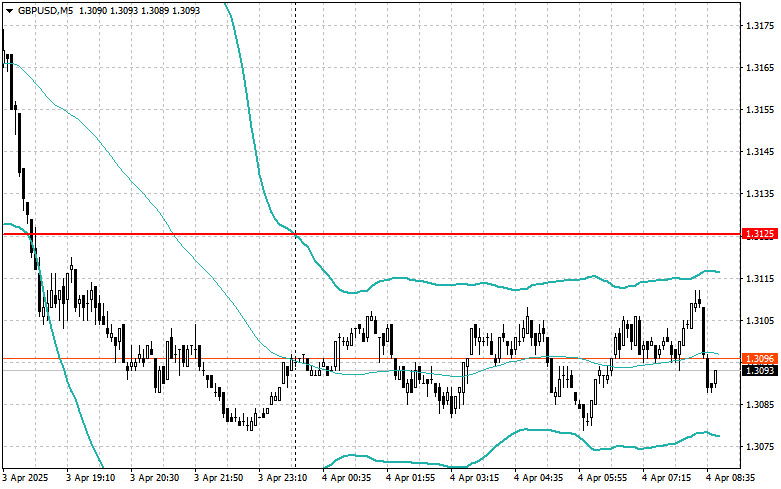

Buying on a breakout above 1.3128 may lead to a rise toward 1.3171 and 1.3204.

Selling on a breakout below 1.3080 may lead to a drop toward 1.3027 and 1.2976.

Buying on a breakout above 145.93 may lead to a rise toward 146.22 and 146.49.

Selling on a breakout below 145.60 may lead to a decline toward 145.28 and 144.95.

I'll look to sell after a failed breakout above 1.1118 and a return below this level.

I'll look to buy after a failed breakout below 1.1037 and a return back to this level.

I'll look to sell after a failed breakout above 1.3125 and a return below this level.

I'll look to buy after a failed breakout below 1.3070 and a return back to this level.

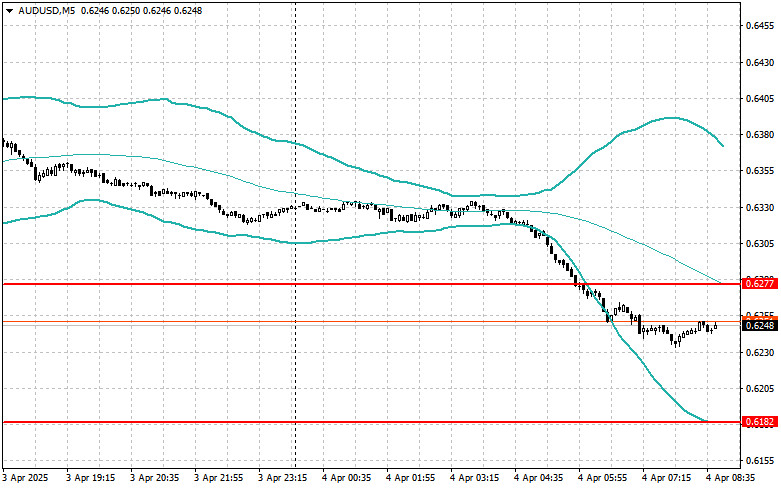

I'll look to sell after a failed breakout above 0.6277 and a return below this level.

I'll look to buy after a failed breakout below 0.6182 and a return back to this level.

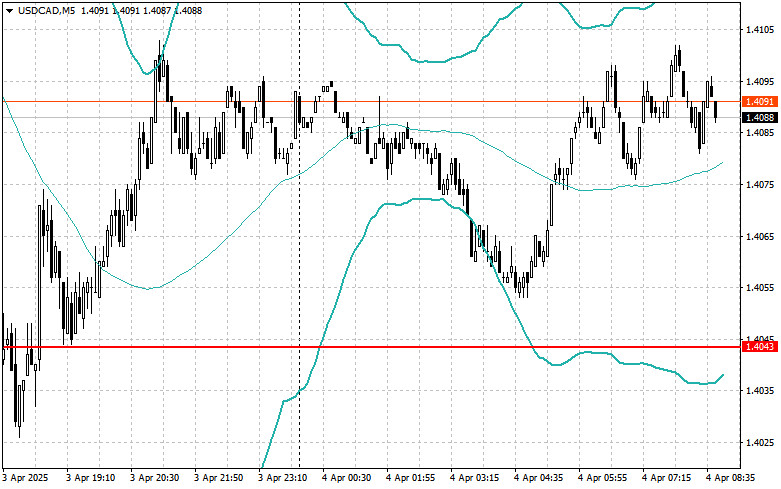

I'll look to sell after a failed breakout above 1.4124 and a return below this level.

I'll look to buy after a failed breakout below 1.4043 and a return back to this level.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Uji level 142,32 terjadi ketika indikator MACD sudah bergerak jauh di atas level nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Karena alasan ini, saya tidak membeli dolar

Pengujian harga pada 1,1382 di paruh kedua hari ini bertepatan dengan dimulainya pergerakan turun indikator MACD dari garis nol, mengonfirmasi titik masuk yang tepat untuk menjual euro. Akibatnya, pasangan

Uji harga di 1.3285 terjadi ketika indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang valid untuk menjual pound. Akibatnya, pasangan ini turun lebih dari

Ulasan dan Saran Trading USD/JPY Tidak ada pengujian terhadap level yang saya tandai di paruh pertama hari ini. Pada paruh kedua hari ini, investor dan trader akan fokus pada indikator

Analisis Trading dan Saran Trading untuk Pound Inggris Pengujian level 1,3325 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi entri pasar yang benar. Namun, seperti yang

Analisis Trading dan Tips untuk Trading Euro Uji level harga 1.1405 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli euro

Pengujian harga di 14068 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolar

Uji level harga 1.3356 bertepatan dengan saat indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang tepat untuk menjual pound. Akibatnya, pasangan ini turun lebih

Video pelatihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.