Lihat juga

02.04.2025 07:04 AM

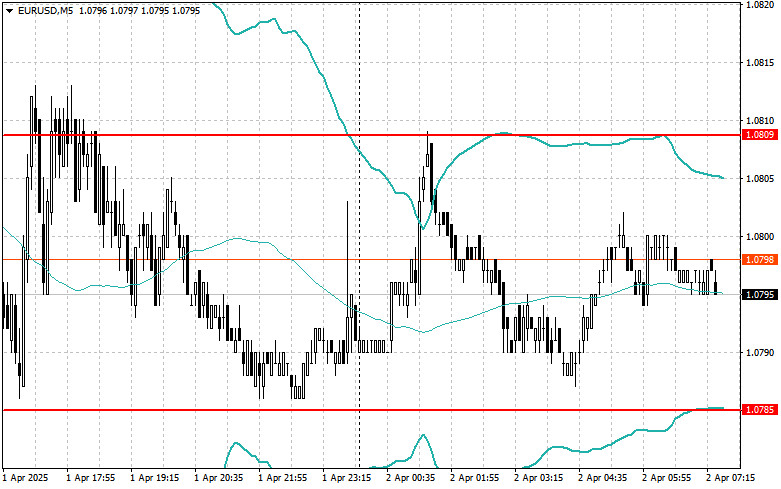

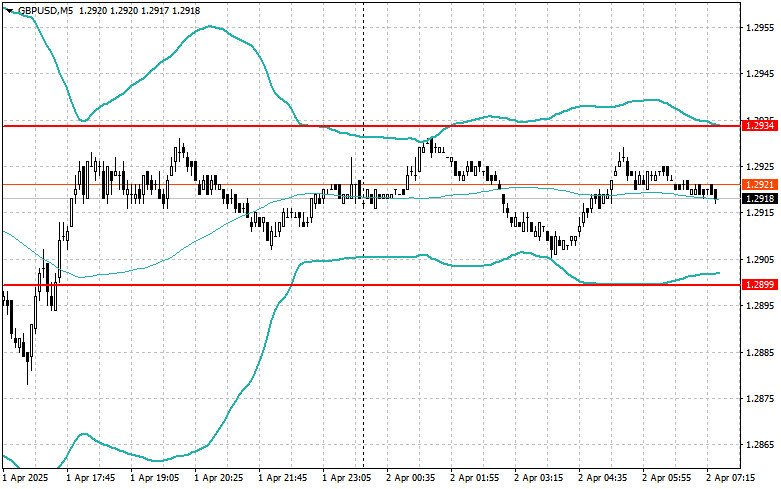

02.04.2025 07:04 AMThe euro and the pound are trading within sideways channels, but both currencies are experiencing increasing pressure. Today's key development is expected to arise from the announcement of trade tariffs by the United States, along with relevant details. There are no significant economic data releases from the eurozone or the UK today.

Yesterday's data showing a slowdown in price growth in the eurozone failed to support the euro since easing inflation gives the European Central Bank room to continue cutting interest rates. The market seems to be pricing in more complex factors than just current inflation figures. Traders will seek additional signals from the ECB regarding the future trajectory of interest rates, paying special attention to how the ECB evaluates the influence of geopolitical tensions from tariffs and the energy crisis on the regional economy.

As mentioned above, there are no eurozone releases in the first half of the day, so trading will likely remain subdued. Traders will likely await news from the U.S., where labor market data is expected. These figures could significantly influence the Federal Reserve's decisions on monetary policy going forward. The focus will also shift toward trade tariffs, which are raising concerns over slowing global growth and prompting market participants to remain cautious and avoid risky assets.

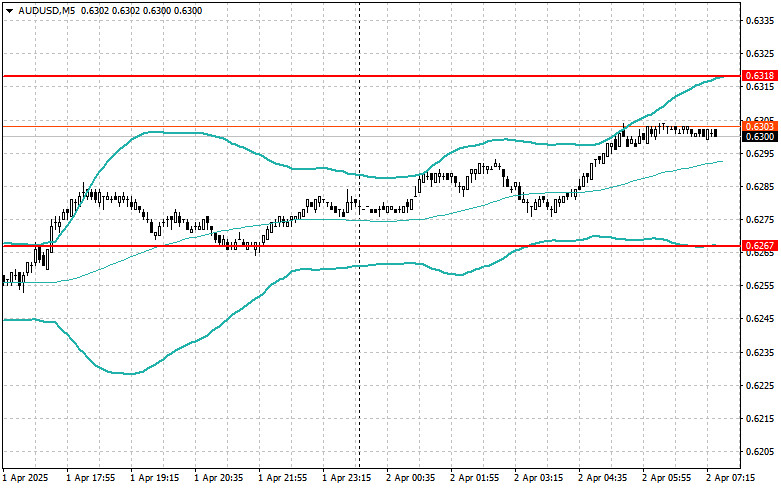

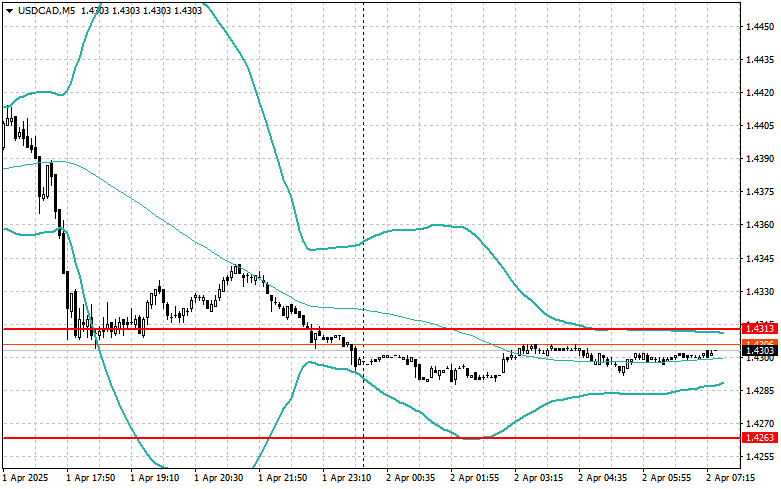

If the information about tariffs matches economist expectations, the Mean Reversion strategy is preferable. If the data turns out significantly above or below expectations, the Momentum strategy would be more appropriate.

Buy on a breakout above 1.0813, targeting 1.0850 and 1.0884

Sell on a breakout below 1.0780, targeting 1.0757 and 1.0730

Buy on a breakout above 1.2939, targeting 1.2970 and 1.2988

Sell on a breakout below 1.2903, targeting 1.2868 and 1.2838

Buy on a breakout above 149.95, targeting 150.20 and 150.50

Sell on a breakout below 149.62, targeting 149.30 and 148.97

Look to sell after a failed breakout above 1.0809 with a return below that level

Look to buy after a failed breakout below 1.0785 with a return back above that level

Look to sell after a failed breakout above 1.2934 with a return below

Look to buy after a failed breakout below 1.2899 with a return back above

Look to sell after a failed breakout above 0.6318 with a return below

Look to buy after a failed breakout below 0.6267 with a return back above

Look to sell after a failed breakout above 1.4313 with a return below

Look to buy after a failed breakout below 1.4263 with a return back above

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian harga pada 145.,20 terjadi ketika indikator MACD bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Namun, hal ini tidak mencegah penjualan dolar AS, karena pengujian

Uji harga di 1,2946 terjadi ketika indikator MACD bergerak jauh di atas garis nol. Namun, uji ini bertepatan dengan rilis data AS yang membenarkan pembelian GBP berdasarkan ekspektasi pelemahan dolar

Pengujian harga di 1,1105 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol. Namun, setelah rilis data utama AS, ini tidak menghalangi masuknya pembelian euro dengan harapan terbentuknya

Euro dan pound melonjak setelah laporan mengungkapkan bahwa inflasi AS turun secara signifikan pada bulan Maret tahun ini. Indeks Harga Konsumen (CPI) AS menurun pada bulan Maret dibandingkan dengan Februari

Ulasan dan Kiat-kiat untuk Trading Yen Jepang Uji harga di 146,88 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang valid ke pasar

Ulasan Trading dan Kiat-kiat Trading untuk Pound Inggris Pengujian harga di 1,2887 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk

Ulasan Trading dan Kiat-kiat untuk Trading Euro Pengujian harga di 1,0974 terjadi ketika indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang valid untuk menjual

Pengujian level harga 144,80 terjadi ketika indikator MACD bergerak jauh di bawah titik nol, sehingga membatasi potensi penurunan pasangan ini. Pengujian kedua pada 144,80 terjadi ketika MACD berada di zona

Uji harga di 1.2803 terjadi tepat saat indikator MACD mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang valid untuk menjual pound. Akibatnya, pasangan ini turun lebih dari

Uji harga di 1,1055 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang valid untuk membeli euro dan menghasilkan kenaikan 30 pip pada pasangan

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.