Lihat juga

02.04.2025 06:25 AM

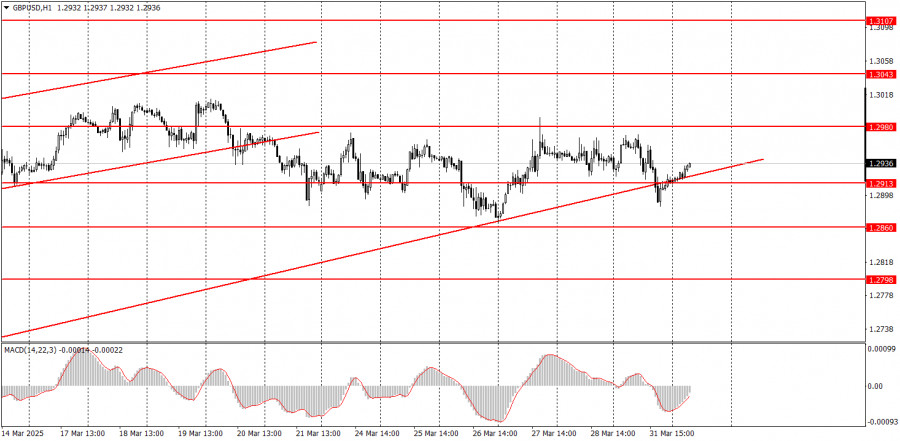

02.04.2025 06:25 AMOn Tuesday, the GBP/USD pair continued trading within a flat range, just as it has for several weeks. The macroeconomic background of the UK and the U.S. had virtually no impact on the pair's intraday movement. Volatility remains quite low, and the price isn't even testing the boundaries of the sideways channel. As we warned at the beginning of the week, a strong macro or fundamental backdrop does not guarantee the end of a flat phase or the emergence of a solid trend.

For example, yesterday's UK Manufacturing PMI came in weak—but so did the U.S. ISM Manufacturing Index and the JOLTS report. So, in theory, the pound could have declined in the first half of the day and the dollar in the second half. In reality, we didn't see clean or logical movements, and yesterday's reports couldn't pull the pair out of its sideways range. As for Donald Trump, there have still been no updates regarding tariffs.

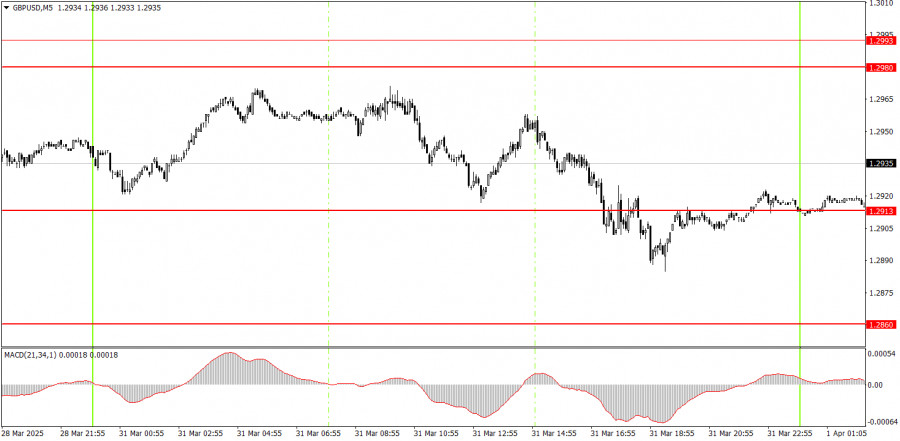

In the 5-minute timeframe, quite a few signals formed near the 1.2913 level on Tuesday, but the movements were random, chaotic, and flat—as we've repeatedly warned recently. The 1.2913 level was practically ignored throughout the day and lies nearly at the center of the sideways channel. And within a flat range, it's generally best to trade bounces from the edges, not the midpoint.

In the 1-hour timeframe, GBP/USD should have already started a downtrend, but Trump continues to do everything possible to prevent that from happening. We still expect the pound to fall toward the 1.1800 target in the medium term. However, no one knows how long the dollar's decline driven by "Trump risk" will last. Once this movement ends, the technical picture across all timeframes could change dramatically. For now, long-term trends still point south.

On Wednesday, the GBP/USD pair may continue trading flat. Remember that even extremely strong macroeconomic reports and fundamental news do not guarantee strong price movement. So, the pair may again remain within the 1.2860–1.2980 range today.

On the 5-minute timeframe, the current key levels for intraday trading are: 1.2301, 1.2372–1.2387, 1.2445, 1.2502–1.2508, 1.2547, 1.2613, 1.2680–1.2685, 1.2723, 1.2791–1.2798, 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107.

No significant events are scheduled in the UK for Wednesday. In the U.S., only the ADP Employment Change report will be released, which isn't particularly impactful since the more critical NonFarm Payrolls will follow it on Friday. However, today, we may finally learn what new tariffs Trump plans to implement—and who he's targeting in the next round of trade battles.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Jumat, pasangan GBP/USD juga melanjutkan pergerakan naiknya. Alasannya sama seperti untuk pasangan EUR/USD. Seluruh latar belakang makroekonomi pada hari Jumat sekali lagi hampir tidak relevan bagi para trader

Pada hari Jumat, pasangan mata uang EUR/USD umumnya melanjutkan pergerakan naik. Dan mengapa harus berhenti? Perang dagang antara AS dan Tiongkok terus meningkat, dengan kedua negara memberlakukan tarif dan sanksi

Pada hari Jumat, pasangan mata uang GBP/USD terus diperdagangkan naik, meskipun kali ini dolar menghindari penurunan besar. Meskipun satu hari tanpa penurunan besar dolar mungkin tampak signifikan, hal ini tidak

Pada hari Jumat, pasangan mata uang EUR/USD melanjutkan reli ultra-kuatnya—sesuatu yang tidak lagi mengejutkan siapa pun. Tarif timbal balik antara AS dan Tiongkok terus meningkat, sementara semua berita lainnya tetap

Dalam prediksi pagi saya, saya menyoroti level 1,2986 dan merencanakan keputusan memasuki pasar dari titik tersebut. Mari kita lihat grafik 5 menit dan analisis apa yang terjadi. Penurunan dan penembusan

Dalam prediksi pagi, saya fokus pada level 1,1336 dan merencanakan keputusan masuk pasar berdasarkan level tersebut. Mari kita perhatikan grafik 5 menit dan analisis apa yang terjadi. Breakout dan pengujian

Dalam 24 jam terakhir, pasangan GBP/USD naik sebanyak 170 pip. Pada malam menjelang Jumat, pound sterling terus menguat. Beberapa hari yang lalu, kami mencatat bahwa dolar telah menguat secara signifikan

Pada hari Kamis, pasangan mata uang EUR/USD melanjutkan pergerakan naiknya dan mencatat kenaikan lebih dari 300 pip. Saat hari Jumat dimulai, pasangan ini terus mengalami pertumbuhan tanpa henti. Alasan

Pada hari Kamis, pasangan mata uang EUR/USD menunjukkan pertumbuhan yang sangat kuat—sebuah pergerakan yang mungkin tidak mengejutkan siapa pun saat ini. Tepat ketika kami melaporkan bahwa tarif terhadap Tiongkok telah

Dalam prediksi pagi saya, saya menyoroti level 1,2871 dan merencanakan untuk membuat keputusan masuk pasar berdasarkan level tersebut. Mari kita lihat grafik 5 menit dan lihat apa yang terjadi. Kenaikan

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.