Lihat juga

02.04.2025 06:25 AM

02.04.2025 06:25 AMOn Tuesday, the EUR/USD currency pair continued to trade in the same mode as in previous weeks. What does that mean? Relatively weak movements, frequent pullbacks and corrections, no clear intraday direction, and overall confusion. We want to remind novice traders that market price movements can vary greatly. Trading signals can also be varied. The number one task for a trader is to trade during a favorable time for them and their trading system. It's no secret that trading systems can be trend-following or range-based. A trend-following system won't work in a flat market. Therefore, during flat conditions, the system must be temporarily adjusted.

Yesterday, a series of fairly important reports from the Eurozone and the U.S. failed to provoke decent price moves. Inflation in the EU slowed down but didn't create significant problems for the euro. U.S. JOLTS and ISM indexes came out weaker than expected, yet the dollar didn't show any notable decline. The market continues to wait and ignore.

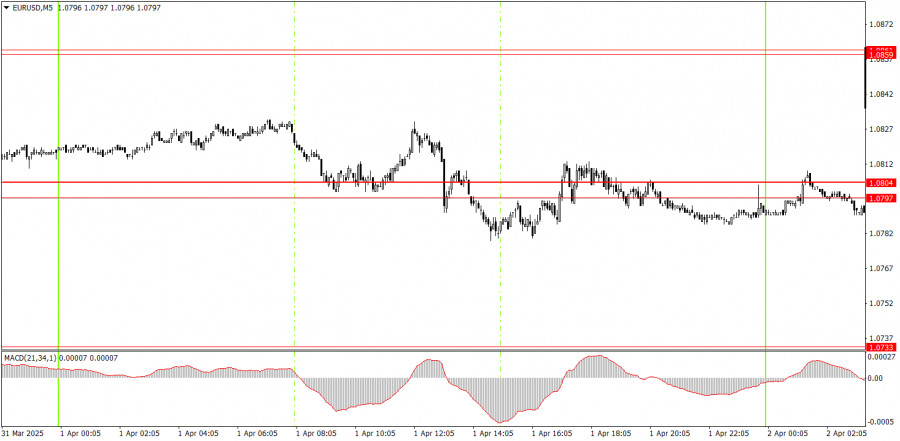

In the 5-minute timeframe, several trading signals were formed on Tuesday, but there's no point in analyzing them. The 1.0797–1.0804 area was crossed and tested multiple times throughout the day. It was impossible to know in advance how the movements would unfold. However, traders could have worked with the first and second signals. Both turned out to be false, but neither resulted in losses. After that, it was better not to open any more positions.

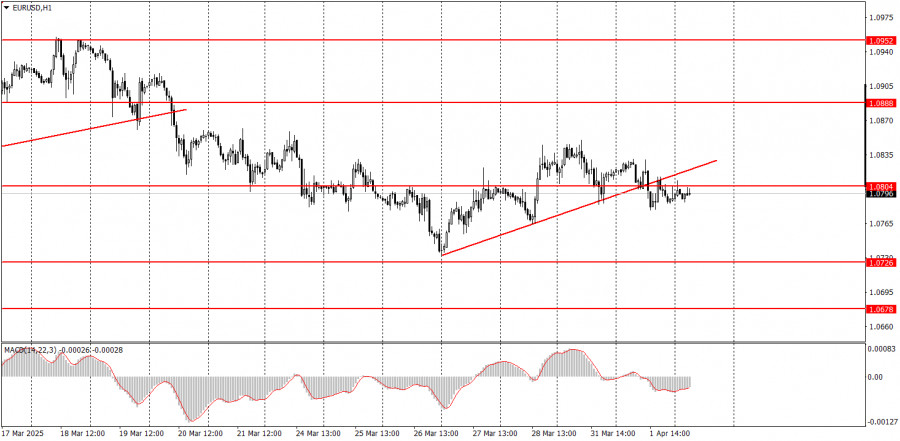

In the 1-hour timeframe, the EUR/USD pair remains in a medium-term downtrend, but the likelihood of its continuation is decreasing. Since the fundamental and macroeconomic backdrop still favors the U.S. dollar far more than the euro, we continue to expect a decline. However, Donald Trump continues to exert significant pressure on the dollar, and the market is visibly nervous and unable to settle on a clear strategy.

The pair may resume its downward movement on Wednesday, but this week is full of important events, which could only add more confusion. Also, today is April 2, and we still haven't heard which tariffs Trump decided to implement.

On the 5-minute chart, consider the following levels for Wednesday: 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, 1.1048.

We note the ADP employment change report in the U.S. from important reports, though it is conditionally important. While there may be some market reaction to this report, the Nonfarm Payrolls report released on Friday is more critical, as it provides a clearer picture of the labor market conditions.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Dalam 24 jam terakhir, pasangan GBP/USD naik sebanyak 170 pip. Pada malam menjelang Jumat, pound sterling terus menguat. Beberapa hari yang lalu, kami mencatat bahwa dolar telah menguat secara signifikan

Pada hari Kamis, pasangan mata uang EUR/USD melanjutkan pergerakan naiknya dan mencatat kenaikan lebih dari 300 pip. Saat hari Jumat dimulai, pasangan ini terus mengalami pertumbuhan tanpa henti. Alasan

Pada hari Kamis, pasangan mata uang EUR/USD menunjukkan pertumbuhan yang sangat kuat—sebuah pergerakan yang mungkin tidak mengejutkan siapa pun saat ini. Tepat ketika kami melaporkan bahwa tarif terhadap Tiongkok telah

Dalam prediksi pagi saya, saya menyoroti level 1,2871 dan merencanakan untuk membuat keputusan masuk pasar berdasarkan level tersebut. Mari kita lihat grafik 5 menit dan lihat apa yang terjadi. Kenaikan

Dalam prediksi pagi, saya menyoroti level 1,1019 dan merencanakan untuk membuat keputusan masuk pasar berdasarkan level tersebut. Mari kita lihat grafik 5 menit untuk memahami apa yang terjadi. Harga memang

Pada pasangan GBP/USD, selama 24 jam terakhir, terjadi kenaikan, kemudian penurunan, dan kemudian kembali naik. Seperti sebelumnya, sulit untuk mengidentifikasi tren yang jelas pada kerangka waktu per jam. Berita tentang

Pada hari Rabu, pasangan mata uang EUR/USD menunjukkan pertumbuhan dan penurunan yang kuat. Belakangan ini, kedua pergerakan tersebut dipicu oleh Donald Trump. Pertama, muncul berita bahwa AS memberlakukan tarif tambahan

Pada hari Rabu, pasangan mata uang GBP/USD menunjukkan pergerakan campuran sepanjang hari tetapi umumnya mempertahankan tren penurunan — jika kita bahkan bisa menyebut perilaku saat ini sebagai "tren." Tidak

Pada hari Rabu, pasangan mata uang EUR/USD bergerak persis seperti yang diharapkan — dalam beberapa aspek. Pertama, mari kita mulai dengan pola "segitiga" yang kita bahas kemarin. Kami memperingatkan bahwa

Pada hari Selasa, pasangan GBP/USD trading dengan sedikit kecenderungan naik. Tidak ada berita besar sepanjang hari, dan hanya pada malam hari muncul berita tentang peningkatan tarif pada China, yang memicu

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.