Lihat juga

28.03.2025 11:29 AM

28.03.2025 11:29 AMAt the close of yesterday's regular trading session, U.S. stock indices ended in the red. The S&P 500 dropped by 0.33%, the Nasdaq 100 fell by 0.53%, and the Dow Jones Industrial Average declined by 0.05%.

Shares of many companies fell after the U.S. imposed tariffs on automakers, intensifying fears of an escalating trade war and offsetting data that showed faster-than-expected growth in the world's largest economy.

Investors rushed to sell assets linked to the automotive industry, fearing reduced profitability and potential disruptions in supply chains. A clear further escalation of the trade conflict could lead to a global recession, as companies may be forced to cut investments and lay off workers. The impact of the tariffs is being felt beyond the auto sector. The metals industry, electronics manufacturers, and agricultural enterprises are also facing uncertainty and rising costs. This is creating an atmosphere of nervousness in financial markets and undermining investor confidence.

Despite trade war concerns, U.S. economic data showed signs of resilience. GDP growth exceeded forecasts, indicating strong domestic demand. However, many economists believe that the positive data may be temporary and will not be enough to offset the long-term negative impact of trade disputes.

With only a few days left in the quarter—which is shaping up to be the worst for the S&P 500 since 2023—market anxiety is intensifying. Auto giants from Toyota Motor Corp. to Mercedes-Benz Group AG and General Motors Co. were hit, along with AppLovin Corp. Meanwhile, bond markets sparked fresh inflation concerns as short-term Treasury yields exceeded those of longer-term debt.

It's worth noting that President Donald Trump signed an executive order imposing a 25% tariff on imported cars and promised harsher penalties for the EU and Canada if they join forces against the U.S. This move overshadowed data showing the U.S. economy grew at a faster pace in the fourth quarter than previously estimated. The inflation figure was revised downward.

Today, another batch of key inflation data is expected, which will shed light on price pressures and economic activity ahead of Trump's planned April 2 announcement of retaliatory tariffs, which he has dubbed "America's Liberation Day." The overall uncertainty surrounding the impact of tariffs on inflation helps explain why Fed officials kept interest rates unchanged last week.

Clearly, in this environment, demand for risk assets remains quite restrained. Only news of a significant slowdown in U.S. price pressures—well below economists' forecasts—could trigger fresh buying in stock markets.

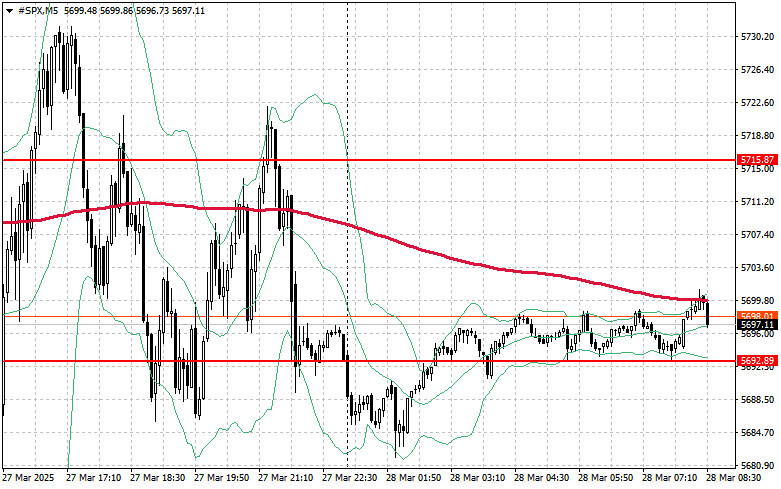

As for the technical outlook on the S&P 500, recovery efforts remain challenging. The main task for buyers today will be to break through the nearest resistance at $5715. This would support continued growth and open the way for a push toward the next level at $5740. An equally important target for the bulls will be reclaiming control over $5766, which would further strengthen their position. If the index moves lower amid fading risk appetite, buyers must step in near $5692. A break below this level would likely drive the index back to $5642 and open the path to $5612.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pasar saham AS baru saja mengalami salah satu gelombang optimisme terkuat dalam beberapa tahun terakhir. Pada hari Rabu, setelah pernyataan dari Presiden Donald Trump, indeks-indeks saham utama mencatatkan kenaikan yang

S&P 500 Ringkasan untuk 10 April Pasar AS bangkit kembali dengan kuat, tetapi perang dagang Trump dengan Tiongkok tetap belum terselesaikan Indeks utama AS pada hari Rabu: Dow +8%, NASDAQ

Pada penutupan sesi trading reguler kemarin, indeks saham AS berakhir dengan kenaikan yang solid. S&P 500 melonjak sebesar 9,52%, sementara Nasdaq 100 meroket sebesar 12,15%. Indeks industri Dow Jones naik

Pasar global kembali bergejolak: eskalasi perang dagang antara AS dan Tiongkok telah mengguncang pasar saham, emas mencetak rekor, Meta terjebak dalam skandal AI, dan Apple berisiko kehilangan hingga $40 miliar

Setelah sesi trading reguler hari Selasa, indeks saham AS kembali ditutup dengan penurunan, berakhir hanya selangkah dari posisi terendah tahunan mereka. S&P 500 turun sebesar 1,57%, Nasdaq 100 jatuh sebesar

Dalam sebuah wawancara kemarin, CEO BlackRock Larry Fink memperingatkan bahwa pasar ekuitas mungkin masih memiliki ruang untuk jatuh, kemungkinan hingga 20%. Namun, ia juga menggambarkan penurunan ini sebagai peluang potensial

S&P 500 Ringkasan untuk 27 Maret Pasar AS mengalami penurunan karena kekhawatiran tarif impor baru dan ketidakpastian ekonomi. Indeks utama AS pada hari Rabu: Dow: -0,3%, NASDAQ: -2,0%, S&P

Video pelatihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.