Lihat juga

27.03.2023 04:43 PM

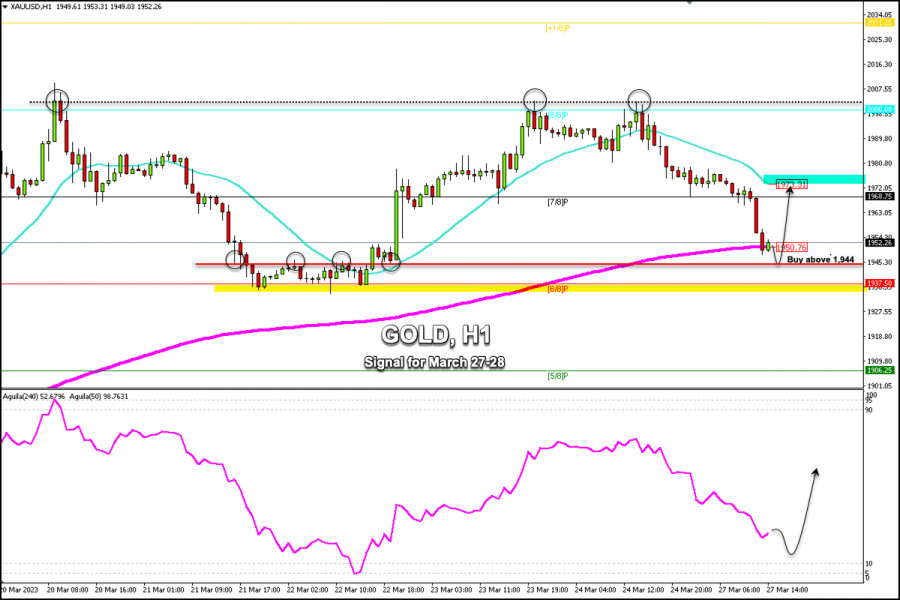

27.03.2023 04:43 PMEarly in the American session, Gold (XAU/USD) is trading around 1,952.26, above the 200 EMA, and below the 21 SMA located at 1,973. Since the opening of this trading week, gold has made a strong technical correction from the level of 1,979.38 towards 1,950. So, it has depreciated by almost $30.

According to the 1-hour chart, we can see that gold has found strong support around 1,944. In the past week, this level has turned out to be a key area of resistance and could now serve as a bottom, which could give the price a technical bounce and it could reach 1,968 (7/8 Murray) and finally the 21 SMA at 1,973.

Gold's average daily volatility is around 600 pips between rises and falls, which could indicate that the market is still nervous and investors are likely to continue to take refuge in gold.

If gold consolidates above 1,950 (200 EMA) in the next few hours, we could expect a rally and the metal could reach 1,968 and 1,973.

On the contrary, in case gold closes below 1,937, the scenario could change and the metal could resume a bearish trend and could reach 5/8 Murray located at 1,906 and finally reach the psychological level of 1,900.

The key will be to watch the 1,937 (6/8 Murray) and the 1,944 level, an area of strong support which could offer a technical bounce and an opportunity to resume buying. The eagle indicator is reaching the oversold zone and it is likely that any pullback has been seen as a signal to buy.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada awal sesi Amerika, emas trading sekitar 3,312 dengan bias bullish setelah menembus segitiga simetris. Emas kemungkinan akan terus naik dalam beberapa jam ke depan, mencapai level 7/8 Murray

Dengan kondisi Stochastic Oscillator yang tengah menuju ke level Oversold (20) pada chart 4 jam dari pasangan mata uang silang AUD/JPY, maka dalam waktu dekat ini AUD/JPY berpotensi untuk melemah

Pada chart 4 jamnya, pasangan mata uang komoditi USD/CAD nampak terlihat bergerak dibawah EMA (100) serta munculnya pola Bearish 123 serta posisi indikator Stochastic Oscillator yang sudah berada diatas level

Pada awal sesi Amerika, emas diperdagangkan sekitar 3.220, menunjukkan tanda-tanda kelelahan. Koreksi teknis lebih lanjut menuju 21SMA kemungkinan akan terjadi dalam beberapa jam ke depan. Pada grafik H4, kita dapat

Dengan munculnya Divergence antara pergerakan harga pasangan mata uang silang EUR/JPY dengan indikator Stochastic Oscillator juga diikuti oleh hadirnya pola Bullish 123 yang diikuti oleh Bullish Ross Hook (RH)

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.