Voir aussi

19.01.2024 03:24 PM

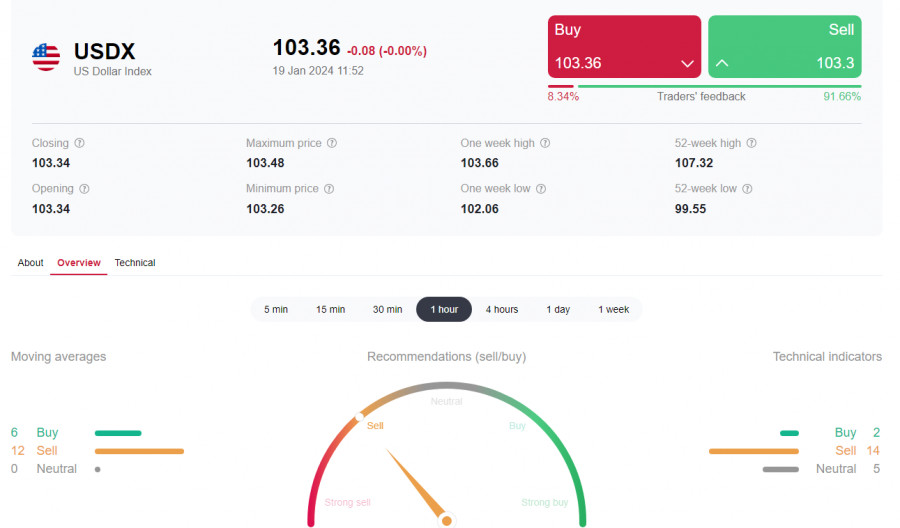

19.01.2024 03:24 PMAt the end of the week, the U.S. Dollar Index (DXY) remains in a range, standing slightly above (by 16 points) the 103.00 mark as of this writing. Meanwhile, the dollar itself, while remaining stable against European currencies, is declining against major commodity currencies such as the Australian, New Zealand, and Canadian dollars.

These currencies, in turn, have resumed their growth against the backdrop of rising U.S. stock indexes, commodity prices, and the dollar's fall against the Chinese yuan.

The strengthening of commodity currencies against the U.S. dollar is also facilitated by technical factors: the pairs USD/CAD, NZD/USD, AUD/USD, as a result of sharp movements, have reached key medium-term resistance/support levels of 1.3485, 0.6105, 0.6600, respectively, which is often followed by a rebound.

The strong bullish impulse for the dollar that emerged at the beginning of the week due to the sharp escalation of the geopolitical situation in the Middle East and the Red Sea region seems to be gradually fading. However, a new escalation of the military conflict in Gaza or a new exchange of strikes by the U.S. and the Houthis could once again trigger a surge in interest in buying the safe-haven dollar. It is possible that Monday may open with another gap in such a case.

Today, investors will be monitoring the release (at 15:00 GMT) of the preliminary Consumer Sentiment Index from the University of Michigan. An increase in the index is expected in January, rising to 70 from 69.7 in December, which could give the dollar a short-term boost.

Also, note that there will be no statements from the Fed over the weekend in anticipation of the meeting on January 31–February 1 (the so-called "quiet week").

Everything that the members of the Federal Reserve's leadership wanted to say regarding the prospects of the U.S. Central Bank's monetary policy, they have already done so. Specifically, Raphael Bostic, head of the Atlanta Fed, said on Thursday that the base scenario involves a cut in rates somewhere in the third quarter, but care must be taken not to lower rates prematurely or risk reigniting the price spiral.

Other Fed leaders have previously expressed similar sentiments about the market's premature expectations of the Fed's monetary policy easing. For example, Fed official Christopher Waller stated the day before that the inflation target of 2.0% is "within reach," but it is premature to rush changes in the interest rate, as it is still unclear whether the inflation slowdown is sustainable. In his opinion, the Fed should act cautiously to avoid economic shocks.

Statements made by Fed officials the day before reduce the likelihood of the start of monetary policy easing at the March meeting. Now it stands at less than 60%, according to CME Group data, compared to a 75% probability at the beginning of the week.

In turn, the dollar received support from the weekly jobless claims data published on Thursday. For the reporting week, the number of initial claims fell from 203,000 to 187,000 (forecasted at 207,000), and the number of continuing claims (for the week of January 5) fell from 1.832 million to 1.806 million (forecasted at 1.845 million). The data suggest that the U.S. labor market retains resilience despite the high interest rates set by the Fed, which, along with the resurgence of inflation, prompts the U.S. Central Bank to postpone the start of monetary policy correction to the second half of the year.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Le début de véritables négociations pourrait entraîner une baisse significative des prix de l'or dans un avenir proche. Dans des articles précédents, j'ai suggéré que la flambée précédente des prix

La paire de devises EUR/USD a continué à se négocier calmement jeudi, bien que la volatilité soit restée relativement élevée. Cette semaine, le dollar américain a montré quelques signes

Quelques événements macroéconomiques sont prévus pour vendredi, mais cela importe peu, car le marché continue d'ignorer 90 % de toutes les publications. Parmi les rapports plus ou moins significatifs d'aujourd'hui

La semaine dernière, la Banque du Canada a maintenu son taux d'intérêt inchangé à 2,75 %, comme prévu. La déclaration qui l'accompagnait avait un ton neutre, soulignant l'incertitude persistante

Le président américain Donald Trump a de nouveau commenté le président de la Réserve fédérale, Jerome Powell, exprimant ouvertement sa mécontentement vis-à-vis du rythme des baisses de taux. Une autre

Notifications

SMS/E-mail

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.