See also

03.04.2025 08:01 AM

03.04.2025 08:01 AMThe euro and the pound resumed growth after news that the reciprocal trade tariffs imposed by the U.S. were roughly in line with market expectations. Although the U.S. stock market encountered new issues, such developments were not observed in the currency market.

Speaking from the White House Rose Garden, Trump announced a 10% tariff on all imports from countries considered key U.S. trading partners. The European Union expects new customs duties to raise current tariffs by 20%. This will undoubtedly force Brussels to prepare for increased import tariffs, increasing costs for European consumers and businesses.

This move could become modern U.S. trade history's most radical protectionist decision. Trump justified his stance by citing the need to protect American manufacturers and jobs from unfair competition by foreign companies. He also emphasized that the current trade system is unfair to the U.S. and that change is long overdue.

Today, demand for the euro may persist, but this will depend on solid fundamental data from the eurozone. Services PMI and composite indices are expected. If the data disappoints, the euro could come under pressure. Traders will also be watching trade tariff headlines, as today marks the start of new car tariffs and potentially the EU's response to these developments.

In the second half of the day, attention will shift to the U.S. ISM Services PMI. The index is expected to remain strong, which could support the U.S. dollar. The eurozone PPI data will also be a focus, which provides key insights into regional inflation trends. Traders closely monitor these figures as they may precede changes in consumer prices and influence future European Central Bank policy. The ECB's monetary policy meeting minutes will also be published, which could offer more clarity on the rate outlook. However, it is already evident that no further rate cuts are expected, suggesting that the euro's strength may continue.

If data aligns with economist expectations, the Mean Reversion strategy is preferable. If data deviates significantly from forecasts, a Momentum strategy is more effective.

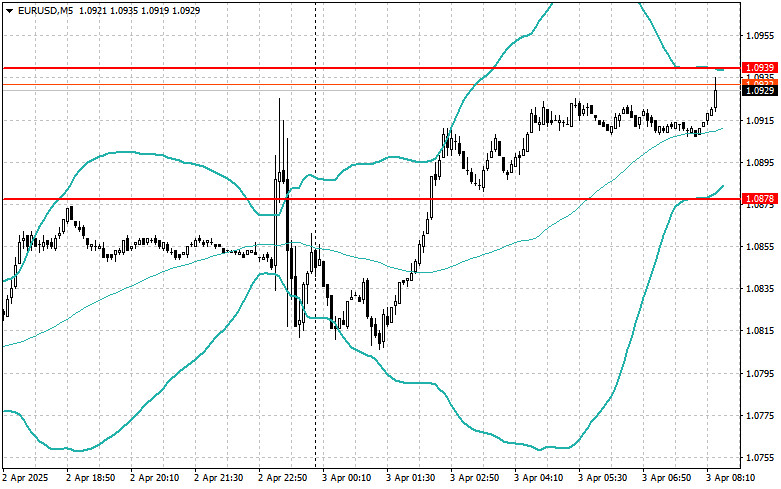

Buy on breakout above 1.0925, target: 1.0952 and 1.0997

Sell on breakout below 1.0884, target: 1.0845 and 1.0810

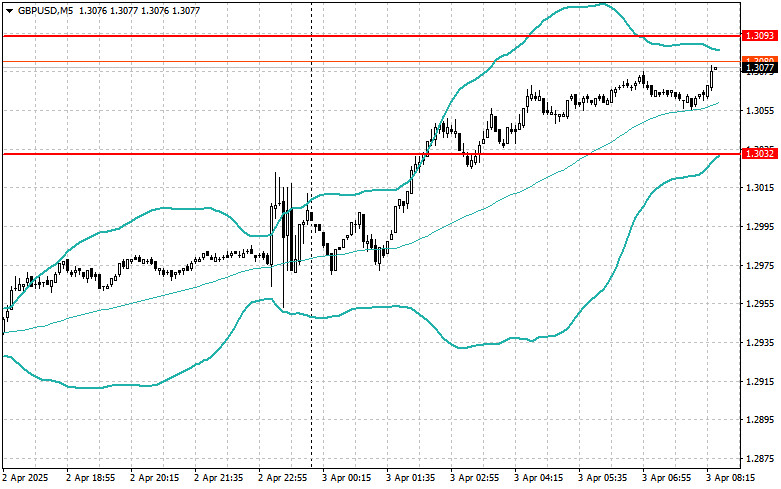

Buy on breakout above 1.3098, target: 1.3131 and 1.3171

Sell on breakout below 1.3050, target: 1.3005 and 1.2955

Buy on breakout above 147.52, target: 148.20 and 148.80

Sell on breakout below 147.15, target: 146.78 and 146.49

Look to sell after a failed breakout above 1.0939 with a return below

Look to buy after a failed breakout below 1.0878 with a return above

Look to sell after a failed breakout above 1.3093 with a return below

Look to buy after a failed breakout below 1.3032 with a return above

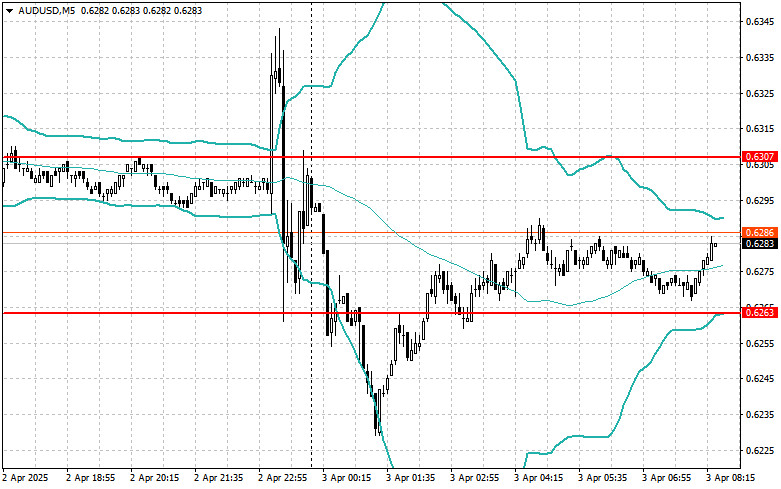

Look to sell after a failed breakout above 0.6307 with a return below

Look to buy after a failed breakout below 0.6263 with a return above

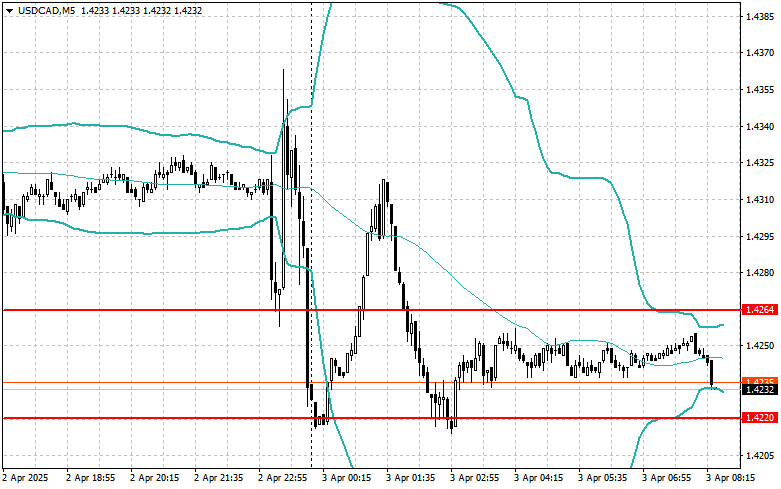

Look to sell after a failed breakout above 1.4264 with a return below

Look to buy after a failed breakout below 1.4220 with a return above

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 142.20 occurred when the MACD indicator had already moved significantly below the zero line, limiting the pair's downside potential. For this reason, I didn't sell

The price test at 1.3268 occurred when the MACD indicator moved significantly above the zero line, limiting the pair's upside potential. For that reason, I did not buy the pound

The test of the 142.38 level coincided with a moment when the MACD indicator had already significantly moved below the zero mark, which limited the pair's downside potential. For this

The test of the 1.3249 price level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. For this reason

The test of the 1.1357 price level occurred when the MACD indicator had already dropped significantly below the zero line, which limited the pair's downside potential. For this reason

Euro and Pound Retain All Prerequisites for Further Growth The single European currency showed virtually no reaction to yesterday's meeting of European Central Bank officials, during which another interest rate

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.