See also

02.04.2025 06:25 AM

02.04.2025 06:25 AMOn Tuesday, the EUR/USD currency pair continued to trade in the same mode as in previous weeks. What does that mean? Relatively weak movements, frequent pullbacks and corrections, no clear intraday direction, and overall confusion. We want to remind novice traders that market price movements can vary greatly. Trading signals can also be varied. The number one task for a trader is to trade during a favorable time for them and their trading system. It's no secret that trading systems can be trend-following or range-based. A trend-following system won't work in a flat market. Therefore, during flat conditions, the system must be temporarily adjusted.

Yesterday, a series of fairly important reports from the Eurozone and the U.S. failed to provoke decent price moves. Inflation in the EU slowed down but didn't create significant problems for the euro. U.S. JOLTS and ISM indexes came out weaker than expected, yet the dollar didn't show any notable decline. The market continues to wait and ignore.

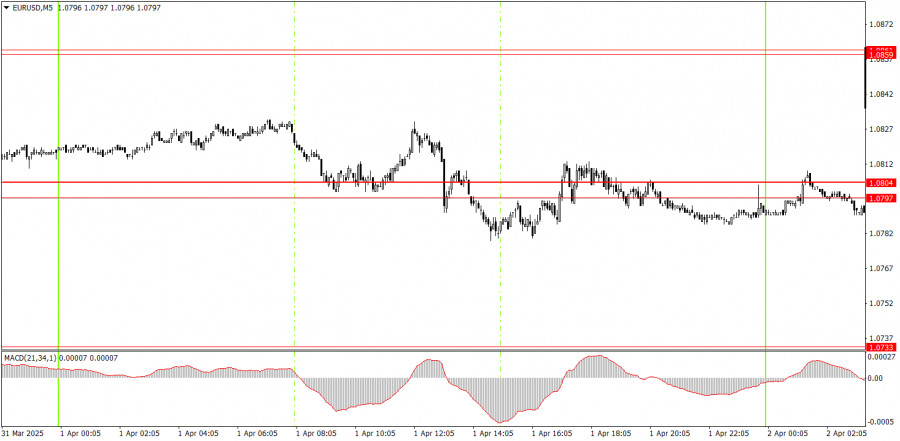

In the 5-minute timeframe, several trading signals were formed on Tuesday, but there's no point in analyzing them. The 1.0797–1.0804 area was crossed and tested multiple times throughout the day. It was impossible to know in advance how the movements would unfold. However, traders could have worked with the first and second signals. Both turned out to be false, but neither resulted in losses. After that, it was better not to open any more positions.

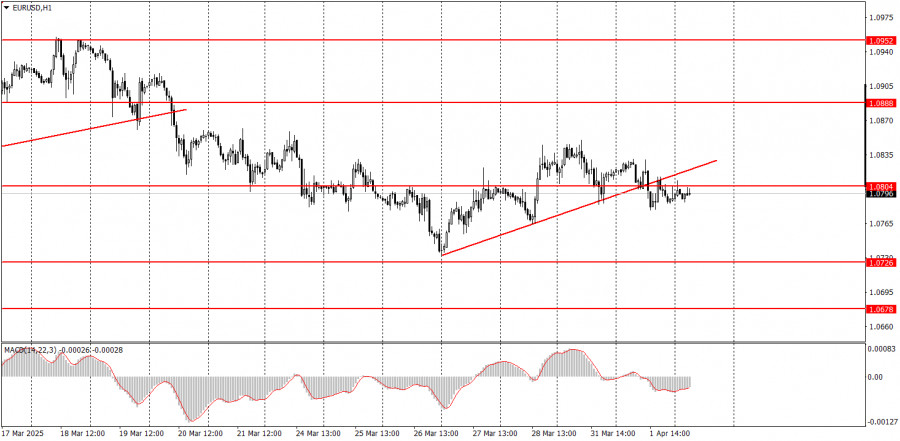

In the 1-hour timeframe, the EUR/USD pair remains in a medium-term downtrend, but the likelihood of its continuation is decreasing. Since the fundamental and macroeconomic backdrop still favors the U.S. dollar far more than the euro, we continue to expect a decline. However, Donald Trump continues to exert significant pressure on the dollar, and the market is visibly nervous and unable to settle on a clear strategy.

The pair may resume its downward movement on Wednesday, but this week is full of important events, which could only add more confusion. Also, today is April 2, and we still haven't heard which tariffs Trump decided to implement.

On the 5-minute chart, consider the following levels for Wednesday: 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, 1.1048.

We note the ADP employment change report in the U.S. from important reports, though it is conditionally important. While there may be some market reaction to this report, the Nonfarm Payrolls report released on Friday is more critical, as it provides a clearer picture of the labor market conditions.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Friday's Trades 1H Chart of GBP/USD On Friday, the GBP/USD pair showed extremely low volatility, yet the British pound steadily crept upward even with such market conditions

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed no movement on Friday. It was Good Friday, and Easter Sunday followed. As a result, many countries

The GBP/USD currency pair traded higher again on Friday, albeit with minimal volatility. Despite the lack of important events in the U.S. or the U.K. that day (unlike earlier

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade higher throughout Thursday. Even at its peak levels, the British pound shows no intention of correcting

Analysis of Thursday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued trading within a sideways channel on Thursday, as shown on the hourly timeframe chart above. The current

The GBP/USD currency pair continued its upward movement on Thursday, trading near multi-year highs. Despite the lack of significant events in the U.S. or the U.K. (unlike Wednesday), the market

The EUR/USD currency pair continued to trade sideways on Thursday. While previously it had been moving within a range between 1.1274 and 1.1391, on Thursday, it was stuck

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.