See also

Bets are now closed, ladies and gentlemen! Many have already played out. The EUR/USD's hesitation to rise following the Bundestag's approval of Friedrich Merz's fiscal stimulus package indicates that this factor is already reflected in the main currency pair. The drop below 1.09 is a result of selling the euro based on the facts, after initial buying on the rumors. The event is significant and comparable to the Marshall Plan for post-war Europe. But its effects will be felt later. For now, all eyes should be on the Federal Reserve.

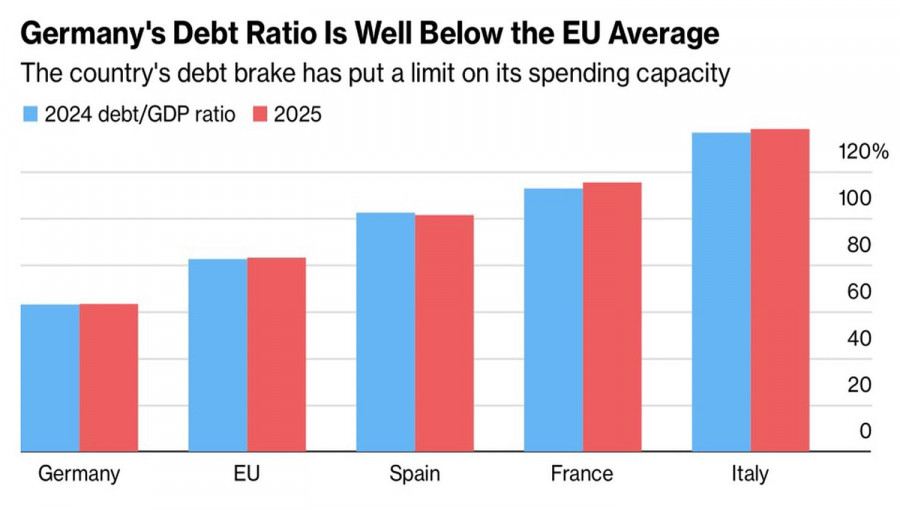

According to Danske Bank, the potential for a EUR/USD rally from current levels is limited, as many bullish drivers have already been factored in. This includes the German fiscal deal, a ceasefire in Ukraine, and three anticipated rate cuts by the Fed in 2025. Germany operated under fiscal restraint for a long time, maintaining the lowest debt-to-GDP ratio among major Eurozone economies.

This frugality held back GDP growth. Moreover, the Ukraine conflict and the resulting energy crisis led to a contraction of the German economy in 2023–2024. Bloomberg estimates that fiscal stimulus could push growth to 2% by 2040.

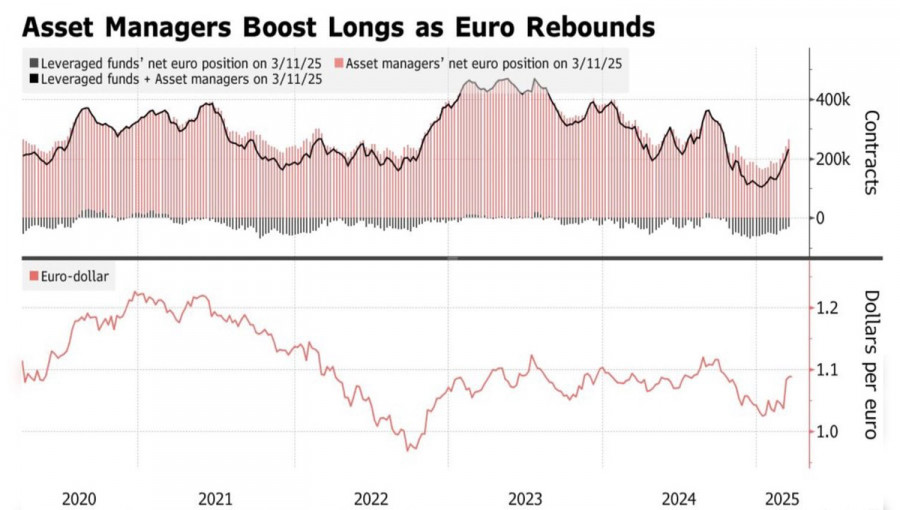

However, this process will take time, meaning speculators may start unwinding long positions on EUR/USD after an extended rally especially since asset managers have pushed net long positions in the euro to a five-month high. In this environment, any event could trigger a sell-off.

Markets are overly optimistic about a swift end to the war in Eastern Europe, which would be excellent news for the Eurozone economy. However, Russia's refusal to agree to a 30-day truce suggests that the White House has plenty of work ahead. Peace is still far off, meaning EUR/USD valuations may have climbed too high.

The futures market currently prices in just under three rate cuts by the Fed in 2025. Even if the FOMC revises its projections from two cuts in December to three, this won't be enough to trigger mass buying of EUR/USD. However, if the Fed signals only two or fewer rate cuts this year, it could be a strong bearish signal for the currency pair.

Let's also not forget the looming trade war between the EU and the U.S., which supports Goldman Sachs' bearish stance on the euro. Despite this, the bank has raised its EUR/USD forecasts from $1.01 to $1.06 (6 months) and $0.99 to $1.02 (12 months).

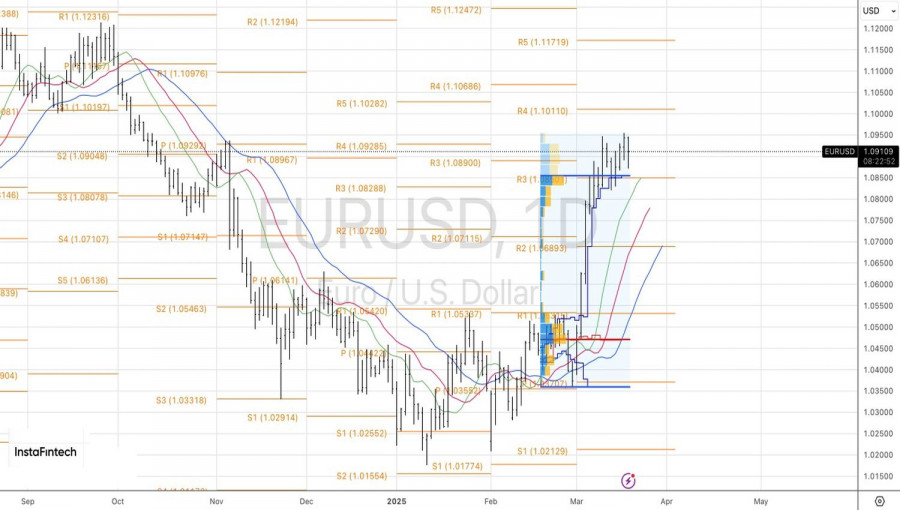

From a technical perspective, the daily EUR/USD chart still risks triggering the Anti-Turtles reversal pattern. Therefore, a drop below 1.089 is a signal to sell. Buying should only be considered if this level holds after testing or if the pair rebounds to 1.093.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.