See also

25.02.2025 01:37 PM

25.02.2025 01:37 PMWhat triggered the 20% crash in BTC/USD from its all-time highs? Was it uncertainty in the White House's policy, investor fatigue with Trump trading, or fraudulent activities involving crypto exchanges?

For a long time, Bitcoin resisted strong headwinds, but once US stock indices suffered a two-day sell-off, bullish patience snapped. Buyers retreated, and soon after, they began to flee en masse.

The first shall be last, and vice versa

In 2025, gold shines brightly, as investors bet that Trump's tariff threats are just a negotiation tactic. Meanwhile, Bitcoin and the US dollar, which surged after the November presidential elections, have now fallen out of favor—for the same reason.

Trump trading is retreating, and investors are tired of his loud rhetoric, which turned out to be more bark than bite. For those still in doubt, just look at Trump's and Melania's memecoins—which soared after his inauguration but then lost over 80% of their value. Investors have also lost confidence in the strategic Bitcoin reserve, the rapid regulatory framework for the crypto industry, and the SEC's crypto-friendly stance.

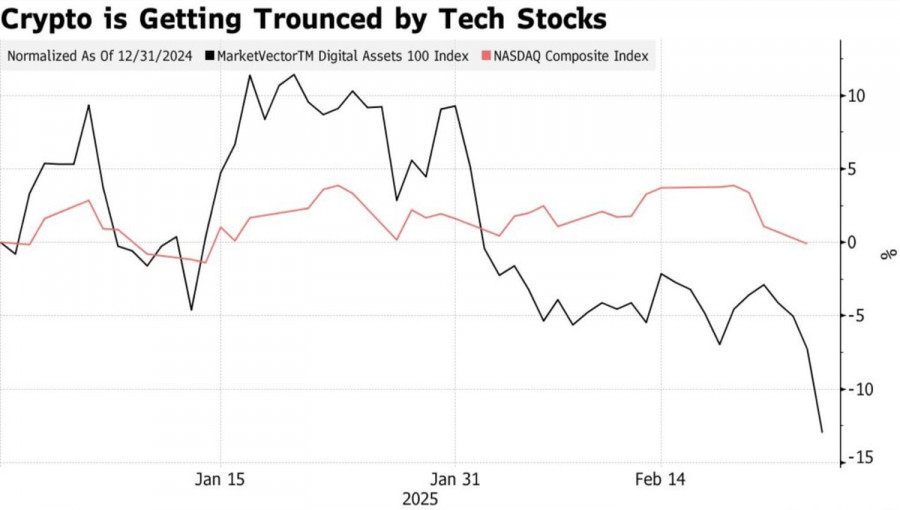

As a result, BTC/USD has started underperforming not only gold but also US high-tech stocks.

Crypto basket vs. NASDAQ performance

Fraud scandals are fueling the crypto sell-off.

OKX admitted to handling $1 trillion in illegal transactions and agreed to pay a $504 million fine. Hackers stole nearly $1.5 billion worth of Ethereum from ByBit. Just like during the previous crypto winter, fraud and regulatory violations are piling up, making investors wary of digital assets. According to CoinGlass, in the past 24 hours alone, $1.34 billion in crypto derivatives positions were liquidated. Meanwhile, the US stock market downturn is adding to the BTC/USD hectic sell-off.

Commonly, a correction in the S&P 500 and Nasdaq signals a decline in global risk appetite. Therefore, as a high-risk asset, Bitcoin has little choice but to fall.

Could BTC/USD be saved by a slowdown in the Fed's preferred inflation gauge—the Personal Consumption Expenditures (PCE) index—for January? Highly unlikely.

In fact, an unexpected surge in the PCE would likely boost demand for the dollar and trigger even more selling of digital assets.

Technical outlook for BTC/USD

On the daily chart, BTC/USD has formed a double-top pattern.

As prices move further away from the moving average combination, the chances of a full trend reversal from bullish to bearish increase. As long as Bitcoin trades below $91,250, selling remains the preferred strategy.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

No macroeconomic events are scheduled for Monday—not in the U.S., the Eurozone, Germany, or the U.K. Therefore, even if the market was paying attention to the macroeconomic backdrop, today, there

On Friday, the EUR/USD currency pair made no notable movements whatsoever. This was unsurprising, as Friday marked Good Friday, and Sunday was Easter. Many banks and trading venues were closed

Today is Good Friday, a day Christians observe worldwide across all denominations. Market activity has noticeably decreased ahead of the Easter holiday, but this isn't the main reason for market

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.