See also

19.02.2024 12:13 PM

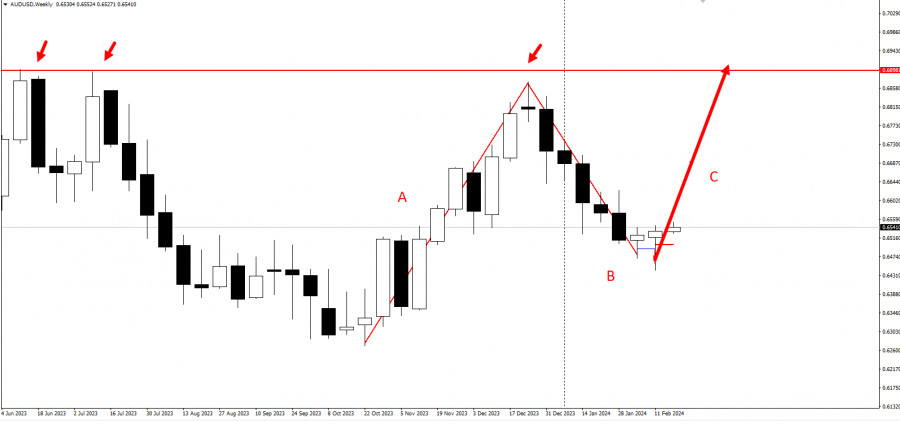

19.02.2024 12:13 PMFollowing a strong upward momentum at the end of last year, AUD/USD pulled back and on the weekly chart demonstrates signs of slowing down the decline, which gives an opportunity for buyers to form long positions.

Looking at the three-wave pattern (ABC) where wave "A" represents the bullish movement at the end of last year, market players could open long positions with stop-loss set at 0.64455. Take profit upon the breakout of 0.69.

Long positions could also be opened below current prices on lower timeframes.

The trading idea follows the framework of the "Price Action" and "Stop Hunting" strategies.

Good luck in trading and don't forget to control the risks! Have a nice day.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Friday's Trades 1H Chart of EUR/USD On Friday, the EUR/USD currency pair generally continued upward movement. And why would it stop? The trade war between the U.S

The GBP/USD currency pair continued trading higher on Friday, although the dollar avoided substantial losses this time. Even though one day without a complete dollar collapse may seem significant

On Friday, the EUR/USD currency pair continued its ultra-strong rally—something no one was surprised by anymore. U.S. and China reciprocal tariffs continue to rise, while all other news remains irrelevant

In my morning forecast, I highlighted the level of 1.2986 and planned to make market entry decisions from that point. Let's take a look at the 5-minute chart and break

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair resumed its upward movement and posted a gain of more than 300 pips. As Friday began

The EUR/USD currency pair showed ultra-strong growth on Thursday—a move that, by now, probably surprised no one. Just as we reported that tariffs on China had been raised to 125%

Graphical patterns

indicator.

Notices things

you never will!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.