See also

19.05.2023 11:29 AM

19.05.2023 11:29 AMBy the end of the week, the sentiment on global markets has noticeably improved. News about active negotiations between Joe Biden and Republican and Democrat leaders in Congress regarding the increase of the national debt ceiling infused some optimism into the market, leading to a notable rise in stock indices. Interestingly, this did affect the US currency.

Why is the US dollar staying afloat even amid increasing demand for risk assets?

Indeed, there was previously a certain correlation when the US dollar came under pressure on Forex. Usually, this happens amid high demand for corporate stocks and other assets like commodities. However, in the current situation, the dollar is receiving support as markets fear that the US Federal Reserve might increase the key interest rate at the meeting on June 14 instead of the expected pause. Here, statements from some Federal Reserve members play a significant role.

On Thursday, Federal Reserve Bank of St. Louis President J. Bullard told the Financial Times that he supported a rate hike as "insurance" against inflation. He added that inflation was declining more slowly than he had anticipated, meaning there is a risk of losing control over it. He expressed fears that, as was the case in the 1970s, it could start to turn upwards again. Dallas Fed President Lorie Logan agreed with her colleague, suggesting that a pause is currently inappropriate and much will depend on the incoming economic statistics data.

This is exactly the kind of sentiment among some Federal Reserve members that is supporting the dollar's rate due to the high probability of a rate hike at the June meeting.

In this regard, markets will especially wait for comments from other US regulator representatives: John C. Williams, Michelle W. Bowman, and, of course, Federal Reserve Chair Jerome Powell. Investors will be looking for clues about a potential interest rate increase next month.

Should we expect any signals from them?

The Fed representatives might give some comments, but Powell is likely to refrain from any statements as there is almost a month ahead of the Fed's meeting. Moreover, some important economic data, such as the unemployment rate, is still to be published. However, the market may react positively to the absence of negative signals today, remaining under the influence of the debt limit negotiations theme, and continuing the local rally on the stock markets. It is quite possible that USD can decline against the basket of major currencies to the level of 102.50.

EUR/USD

The pair is currently oversold. If ECB President Christine Lagarde confirms today that the regulator will continue to raise the rate, the pair may pass the level of 1.0800 and head for the upper target at 1.0900 amid an overall optimistic sentiment in the market.

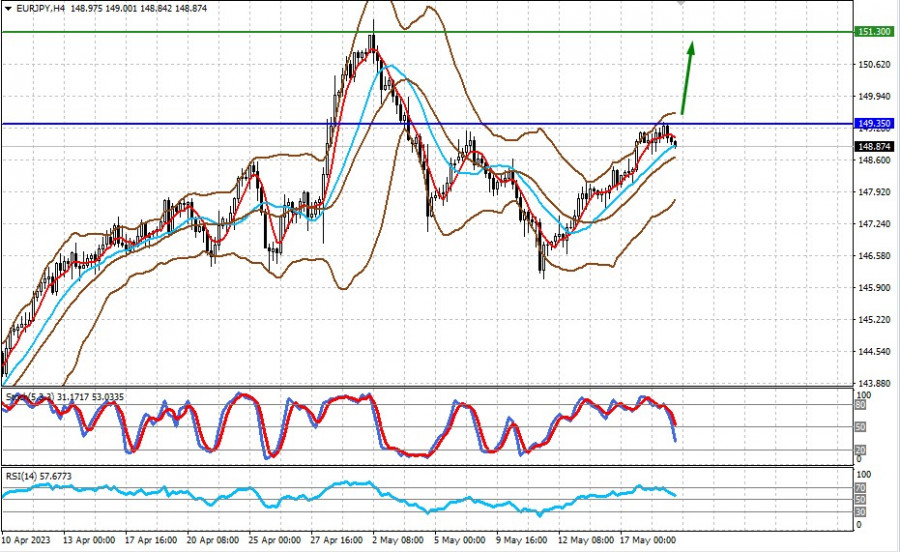

EUR/JPY

The pair may also gain support amid Lagarde's speech regarding further rate hikes. If so, the price may break above the 149.35 level, aiming at the next target at 151.30.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Monday, the U.S. stock market experienced a sharp decline, pulling down many global exchanges, as the "turbulent" actions of President Trump continue to shift from one hot topic

No macroeconomic events are scheduled for Tuesday—neither in the U.S., the Eurozone, Germany, nor the U.K. Thus, even if the market were paying any attention to macroeconomic data, it simply

The GBP/USD currency pair also traded higher on Monday despite no clear reasons or fundamental grounds for this movement. However, the pound has risen even on days when the euro

The total speculative bearish position on the US dollar more than doubled over the reporting week, reaching -$10.1 billion. The Canadian dollar and the yen strengthened the most, while

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.