See also

28.02.2023 03:30 PM

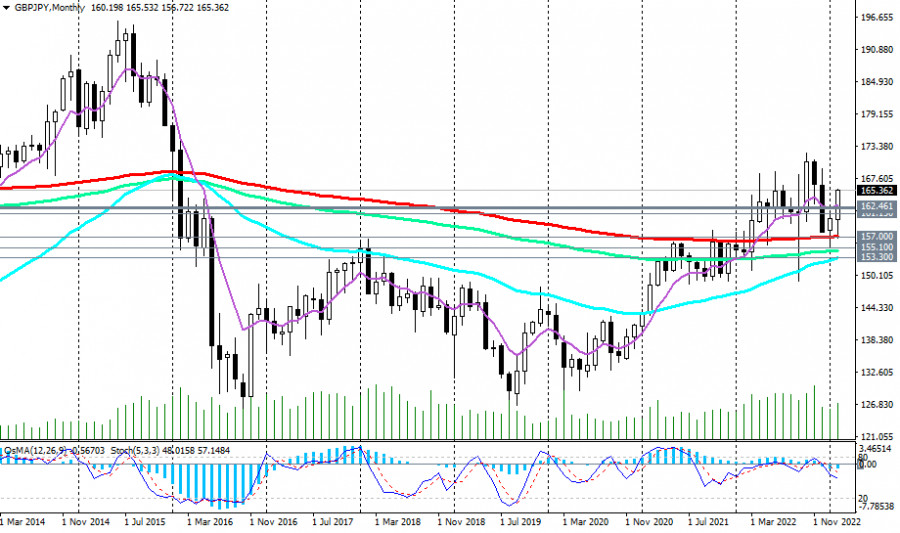

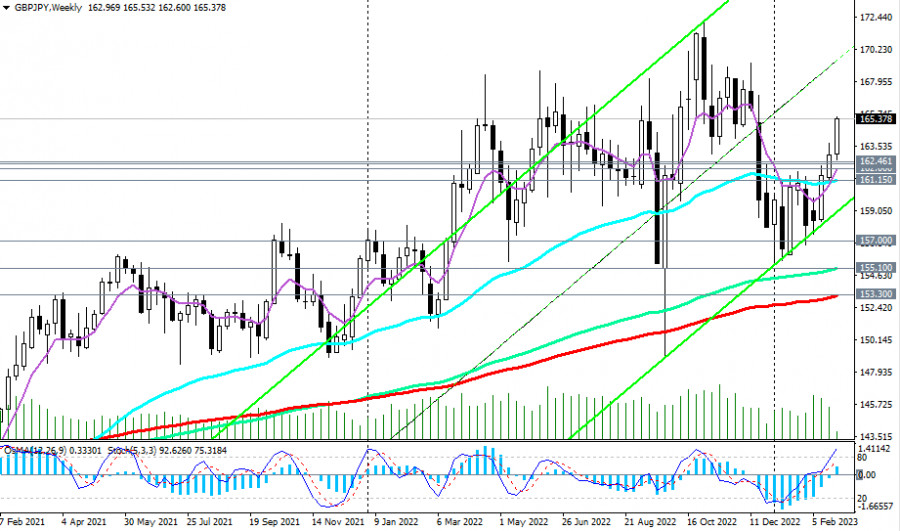

28.02.2023 03:30 PMThe yen is weakening amid comments of incoming Bank of Japan Governor Kazuo Ueda, while the pound is strengthening in the major cross pairs. That is accordingly true for the GBP/JPY, which as of writing, was trading above 165.30, having strengthened by 1.5% just in the last two incomplete trading days and has been in the bull market zone for two years since the breakdown of 142.00.

Today, GBP/JPY continued to rise, trading above the key support levels 162.00 (200 EMA on the daily chart), 157.00 (200 EMA on the monthly chart), 153.30 (200 EMA on the weekly chart).

Technical indicators OsMA and Stochastic on the daily and weekly charts are also on the buyers' side, while a strong bullish momentum pushes the pair towards last year's highs above 172.00.

In an alternative scenario, the first signal to sell may be a breakdown of the local low 165.05, and today's local low at 164.08. In the meantime, long positions remain preferable, short positions are considered only as a short-term alternative.

Support levels: 164.00, 163.00, 162.46, 162.30, 162.00, 161.15, 157.00

Resistance levels: 166.00, 167.00, 168.00, 169.00, 170.00, 171.00

Trading scenarios

Sell Stop 164.90. Stop-Loss 165.60. Take-Profit 164.00, 163.00, 162.46, 162.30, 162.00, 161.15, 157.00

Buy on the market, Buy Stop 165.60. Stop-Loss 164.90. Take-Profit166.00, 167.00, 168.00, 169.00, 170.00, 171.00

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In my morning forecast, I highlighted the 1.3247 level as a reference point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened

In my morning forecast, I highlighted the 1.1341 level as a key point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened there

Analysis of Tuesday's Trades 1H Chart of GBP/USD Throughout Tuesday, the GBP/USD pair continued its upward movement. As we can see, the British currency doesn't need any particular reason

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair pulled back slightly, which can be considered a purely technical correction. Yesterday — and generally —

On Tuesday, the GBP/USD currency pair continued its upward movement for most of the day. There were no significant reasons or fundamental grounds for this, but the entire currency market

The EUR/USD currency pair began a long-awaited decline on Tuesday, although it didn't fall very far or for very long. It's worth noting that there were no fundamental reasons

In my morning forecast, I highlighted the 1.1377 level and planned to make trading decisions from there. Let's look at the 5-minute chart and break down what happened. A rise

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair continued its upward movement without any trouble. There were no macroeconomic reasons for this, and even

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.