See also

13.01.2023 01:30 PM

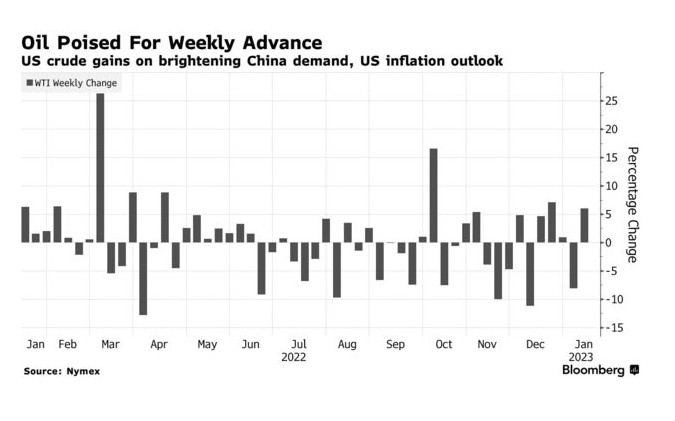

13.01.2023 01:30 PMOil posted a weekly gain, rebounding after a weak start to the year on improved demand forecasts in China and slowing inflation in the US.

China ramped up purchases of crude this week after Beijing imposed a new import quota. Consumption is poised for record growth this year following the dismantling of Covid Zero in the country.

In December, consumer prices in the US fell for the first time since 2020, fuelling expectations that the Federal Reserve will slow the pace of rate hikes. This added some bullish sentiment to financial markets.

Oil edged higher after a bumpy start to the year. Analysts from Goldman Sachs Group Inc. to top hedge fund manager Pierre Andurand predict that prices will surge above $100 per barrel in 2023. In addition, there are signs that trading activity has picked up in the new year.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Thursday, investors realized there is currently no such thing as stability. High market volatility remains and will continue to dominate for some time. The ongoing cause of this remains

A relatively large number of macroeconomic events are scheduled for Friday, but none are expected to impact the market. Of course, we may see short-term reactions to individual reports

The GBP/USD currency pair also traded higher on Thursday. As a reminder, macroeconomic and traditional fundamental factors currently have little to no influence on currency movements. The only thing that

The GBP/USD currency pair also showed strong growth on Thursday, although not as strong as the EUR/USD pair. The pound gained only around 200 pips—which isn't a considerable move under

The CPI report released on Thursday showed weaker-than-expected inflation. The market responded accordingly: the U.S. dollar came under renewed pressure (the U.S. Dollar Index fell into the 100.00 range)

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.