#WDC (Western Digital Corporation). Exchange rate and online charts.

Currency converter

10 Jan 2025 22:59

(-0.11%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

WDC is a ticker symbol for the shares of Western Digital Corporation traded on the NYSE. Currency: USD. Western Digital’s index membership is NASDAQ-GS and S&P 500.

Western Digital Corp is the world’s leading manufacturer of computer hardware. The concern’s brand names are WD and Western Digital. The company is headquartered in San Jose, California. It has factories in Malaysia and Thailand, engineering units in California, and sales offices in most parts of the world.

History of development

Western Digital (WDC) was founded in 1970 by former Motorola employee Alvin B. Phillips. The original name is General Digital.

Throughout the first half of the 1970s, the company was manufacturing chips for electronic calculators under the new name Western Digital. In the early 1980s, WD started to produce controllers for hard drives.

In 1983, WD won the contract to provide IBM with controllers for the PC/AT, making the WD1003 chip the basis for the ATA interface.

In 1986, the company acquired Paradise Systems Inc, the leading developer of video controllers for IBM PC compatibles, and started to produce WDC graphics cards.

In 1986, WD purchased the manufacturer of SCSI controller chips for disk and tape devices.

In 1987, the corporation acquired Faraday Electronics, a manufacturer of core logic chipsets.

In 1991, WD introduced a series of hard drives called Caviar. Amid the successful sales of these drives, the company started to sell some of its divisions.

In 1998, the firm gained access to IBM technologies and factories.

In 1999, WD introduced the Expert line of drives, which helped it regain respect among users and forced the company to boost its hard drive production.

In 2003, following the purchase of Read-Rite Corporation, a manufacturer of magnetic recording heads, WD offered the world's first Serial ATA HDD (SATA) hard drive interface.

In 2009, the acquisition of Siliconsystems allowed the company to enter the solid-state drive market.

In 2011-2012, Western Digital purchased Hitachi for $4.3 billion to become the largest hard drive manufacturer in the world.

In 2016, WD acquired SanDisk, the largest manufacturer of flash memory products.

Today, any memory storage device - from virtual space and modern data centers to mobile sensors and personal devices - uses Western Digital Corporation’s technologies.

Revenue, equity, achievements

WD describes itself as a company that has long been at the forefront of changing innovations - from the invention of the first hard drives to the latest developments in the 3D NAND technology (multilevel flash memory).

Western Digital Corp is engaged in the development, production, marketing, and sale of the following product categories:

- Client Devices - mobile, desktop, gaming and digital video, hard drives, solid state drives (SSD), embedded products, and wafers;

- Datacenter Devices and Solutions - enterprise hard disk drives (HDD), enterprise solid state drives, datacenter software;

- Client Solutions - hard drive content solutions and flash content solutions.

WDC also generates license and royalty revenue from IP (intellectual property), which is included in each of these three categories.

Western Digital's total revenue amounted to $19.09 billion in 2017, $20.65 billion in 2018, $16.57 billion in 2019, and $16.74 billion in 2020.

The company’s total equity is $9.97 billion. It has $26.37 billion in total assets and 61,800 employees (approximate data as of 2019).

In 2016, its capitalization was $19 billion, $24 billion in 2017, $11 billion in 2018, $19 billion in 2019, and $17 billion in 2020. Market capitalization is $20,600,340,147.

See Also

- Potential for the further rally in Crude

Author: Petar Jacimovic

11:55 2025-01-10 UTC+2

5128

Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin.Author: Sebastian Seliga

12:24 2025-01-10 UTC+2

5083

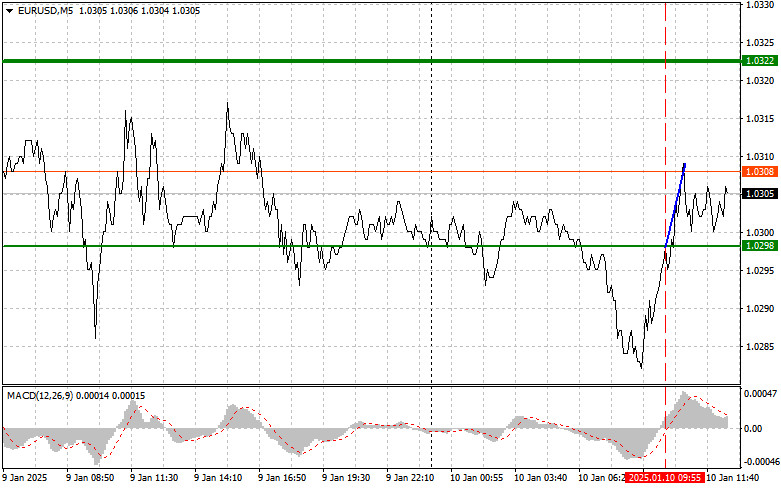

A test of the 1.0298 level coincided with the MACD indicator beginning to move upward from the zero markAuthor: Jakub Novak

13:08 2025-01-10 UTC+2

1813

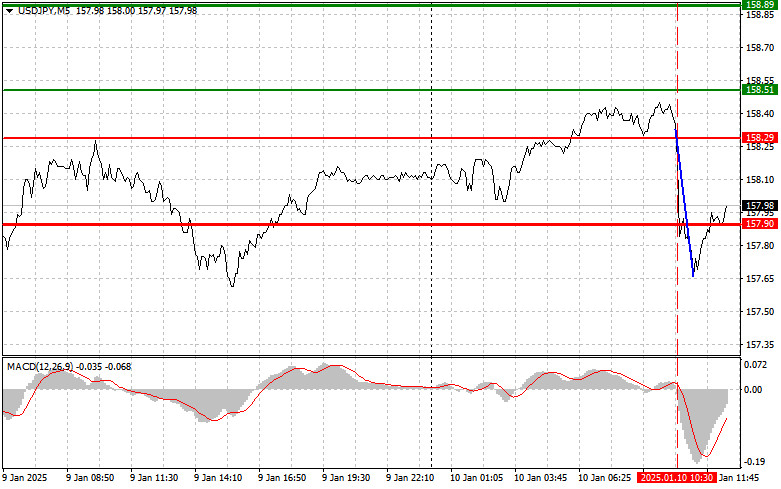

- A test of the 158.29 level occurred when the MACD indicator was just beginning to move downward from the zero mark

Author: Jakub Novak

13:13 2025-01-10 UTC+2

1738

Technical analysisTrading Signals for GOLD (XAU/USD) for January 10-13, 2025: sell below $2,695 (21 SMA - 5/8 Murray)

On the H1 chart, gold is reaching overbought levels. So, we will look for opportunities to sell in the next few hours, with targets at 2,675 and 2,665.Author: Dimitrios Zappas

17:02 2025-01-10 UTC+2

1633

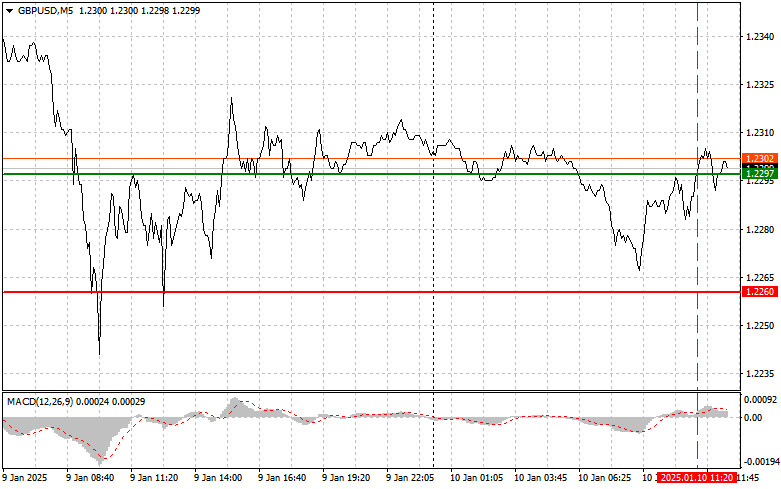

A test of the 1.2297 level during the first half of the day occurred when the MACD indicator had already moved significantly above the zero markAuthor: Jakub Novak

13:11 2025-01-10 UTC+2

1633

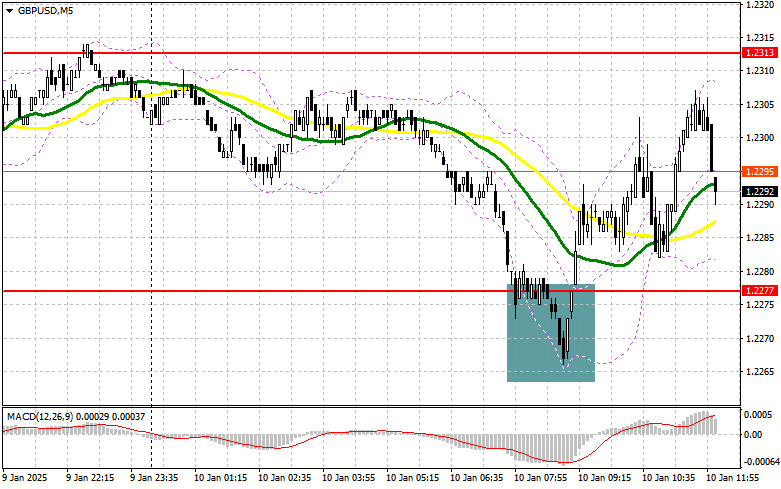

- Trading plan

GBP/USD: Trading Plan for the U.S. Session on January 10th (Analysis of Morning Trades)

In my morning forecast, I highlighted the 1.2277 level and planned to make trading decisions based on itAuthor: Miroslaw Bawulski

13:06 2025-01-10 UTC+2

1603

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on January 10. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on January 10. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-01-10 UTC+2

1498

The uptrend in BTC/USD risks shifting into a correctionAuthor: Marek Petkovich

09:58 2025-01-10 UTC+2

1498

- Potential for the further rally in Crude

Author: Petar Jacimovic

11:55 2025-01-10 UTC+2

5128

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin.

Author: Sebastian Seliga

12:24 2025-01-10 UTC+2

5083

- A test of the 1.0298 level coincided with the MACD indicator beginning to move upward from the zero mark

Author: Jakub Novak

13:08 2025-01-10 UTC+2

1813

- A test of the 158.29 level occurred when the MACD indicator was just beginning to move downward from the zero mark

Author: Jakub Novak

13:13 2025-01-10 UTC+2

1738

- Technical analysis

Trading Signals for GOLD (XAU/USD) for January 10-13, 2025: sell below $2,695 (21 SMA - 5/8 Murray)

On the H1 chart, gold is reaching overbought levels. So, we will look for opportunities to sell in the next few hours, with targets at 2,675 and 2,665.Author: Dimitrios Zappas

17:02 2025-01-10 UTC+2

1633

- A test of the 1.2297 level during the first half of the day occurred when the MACD indicator had already moved significantly above the zero mark

Author: Jakub Novak

13:11 2025-01-10 UTC+2

1633

- Trading plan

GBP/USD: Trading Plan for the U.S. Session on January 10th (Analysis of Morning Trades)

In my morning forecast, I highlighted the 1.2277 level and planned to make trading decisions based on itAuthor: Miroslaw Bawulski

13:06 2025-01-10 UTC+2

1603

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on January 10. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on January 10. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:13 2025-01-10 UTC+2

1498

- The uptrend in BTC/USD risks shifting into a correction

Author: Marek Petkovich

09:58 2025-01-10 UTC+2

1498