Careers

Success of any company is the result achieved by real people – the company’s staff.

Join a tight-knit team of professionals with each of them having proper qualification and working in a masterly manner.

Employee care is one of the main priorities of InstaTrade Company ensuring its leadership from the establishment stage up to now.

Today InstaTrade Company has over 120 employees working not only in Russia, but also in Europe and Asia. We do our best to make our staff proud of moving up the InstaTrade career ladder. Working for InstaTrade Company is a perfect way to advance your professional skills and take advantage of excellent career prospects.

We bid welcome energetic and open-minded people striving for new achievements. If you are interested in reaching success in the financial field as part of a dynamically developing international company, InstaTrade enables you to embrace this opportunity with great pleasure.

We appreciate insight into the financial trading essence, experience in online work on the financial markets and at financial companies, good knowledge of English and other foreign languages (the Russian, European or Asian languages) and skills of working at an organisation.

If you are interested in our offer, send your CV to our email address: career@mail.instaforex.com

See Also

- The EUR/USD exchange rate remained virtually unchanged throughout Friday.

Author: Chin Zhao

20:26 2025-04-25 UTC+2

2398

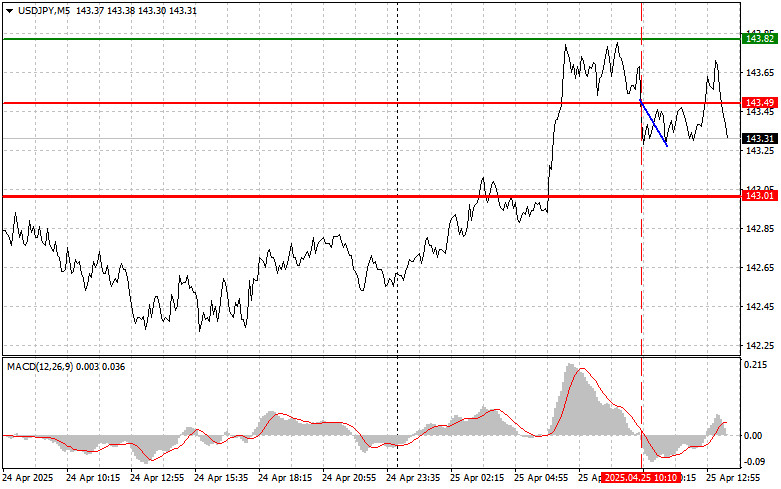

USD/JPY: Simple Trading Tips for Beginner Traders � April 25th (U.S. Session)Author: Jakub Novak

20:09 2025-04-25 UTC+2

2158

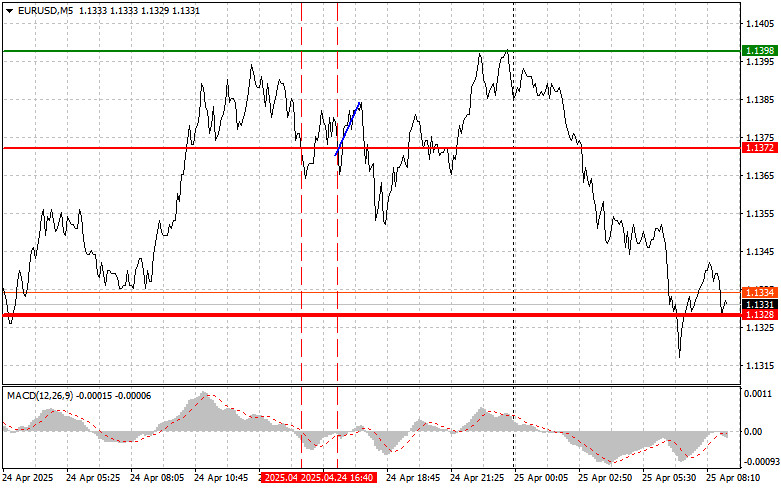

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:31 2025-04-25 UTC+2

2008

- Fundamental analysis

Why Could Gold Prices Drop Significantly? (There's a chance gold will continue to decline while the CFD on the NASDAQ 100 futures contract may rise)

The beginning of actual negotiations could lead to a significant drop in gold prices in the near futureAuthor: Pati Gani

10:14 2025-04-25 UTC+2

2008

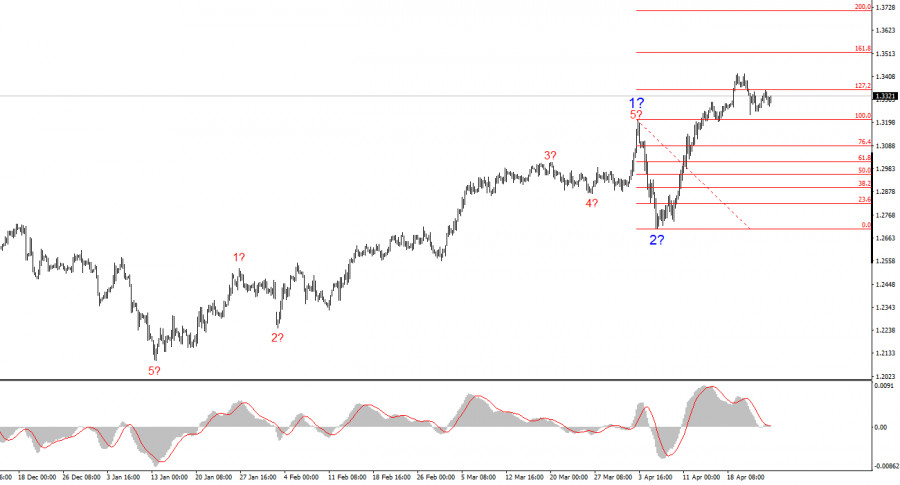

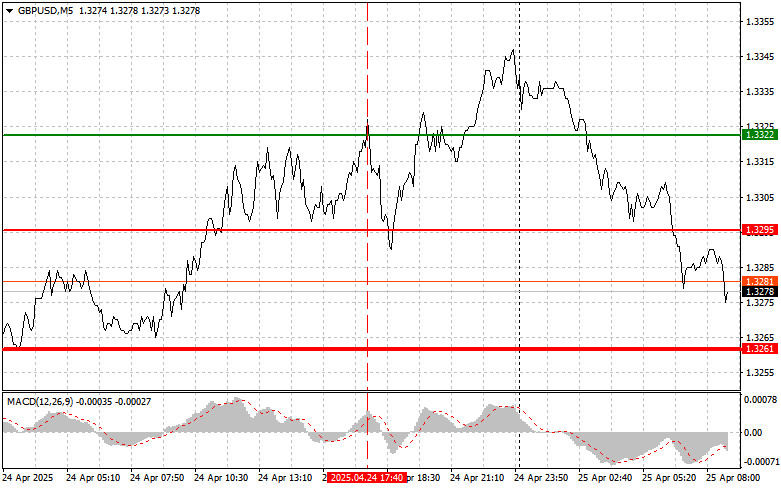

The GBP/USD pair saw virtually no change on Friday, with price movement remaining very limited throughout the day.Author: Chin Zhao

20:21 2025-04-25 UTC+2

1993

Technical analysis / Video analyticsForex forecast 25/04/2025: EUR/USD, GBP/USD, USD/JPY and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY and BitcoinAuthor: Sebastian Seliga

12:25 2025-04-25 UTC+2

1978

- Type of analysis

GBP/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:31 2025-04-25 UTC+2

1903

Gold maintains a bearish tone today, though it has slightly recovered from the daily low, climbing back above the $3300 level.Author: Irina Yanina

12:23 2025-04-25 UTC+2

1888

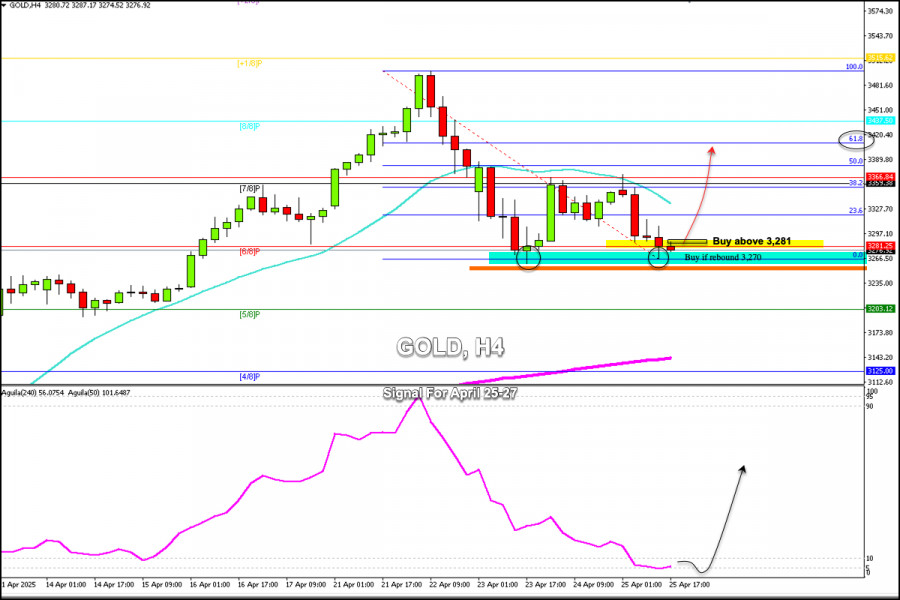

Technical analysisTrading Signals for GOLD (XAU/USD) for April 25-29, 2025: buy above $3,270 (21 SMA - rebound)

Our trading plan for the coming hours is to buy above 3,270 or above 3,281, with short-term targets around 8/8 of Murray.Author: Dimitrios Zappas

18:02 2025-04-25 UTC+2

1888

InstaTrade at Traders Lagos Expo: High Interest and Well-Deserved Recognition

Traders Lagos Expo is one of the largest financial events in West Africa, bringing together over 2,000 participants interested in investments, brokerage services, and cutting-edge trading solutions. We’re proud to have been the main sponsor of the expo and to have taken an active part in it, presenting the InstaTrade brand as a reliable and ambitious player on the global stage, while also building valuable connections and strengthening our presence in the regional market. The event kicked off with an opening speech by our company representative, setting a confident and business-focused tone for the entire expo. The speech emphasized InstaTrade’s commitment to growth, innovation, and supporting both clients and partners.

- 2025-03-05 10:41:00Yen Falls Amid Risk-on MoodQuick show2025-03-05 10:23:00*South Africa Feb S&P Global PMI 49.0 Vs. 47.4 In JanuaryQuick show2025-03-05 10:08:00Australia GDP Growth Tops ExpectationsQuick show2025-03-05 09:37:00South Korea GDP Growth Confirmed At 0.1%Quick show2025-03-05 09:22:00China Keeps Growth Target At "Around 5%" Despite Tariff ThreatsQuick show2025-03-05 09:09:00*Estonia Jan Manufacturing Output Down 5.8% M-o-MQuick show2025-03-05 09:07:00*Estonia Jan Industrial Output Falls 2.5% On Year Vs. -4.4% In DecemberQuick show2025-03-05 09:06:00*Estonia Jan Industrial Output Falls 6.0% On Month Vs. +1.3% In DecemberQuick show2025-03-05 09:03:00*Estonia Jan Manufacturing Output Rises 2.0% Y-o-Y Vs. -2.5% In DecemberQuick show2025-03-05 09:01:00*Russia Feb Services PMI 50.5 Vs. 54.6 In JanuaryQuick show

- 2025-03-05 13:18:00*Lebanon Feb PMI 50.5 Vs. 50.6 In Jan, Consensus 50.9 - S&P Global/Blominvest BankQuick show2025-03-05 13:14:00*Ghana Feb S&P Global PMI 50.5 Vs. 47.9 In Jan, Consensus 50.0Quick show2025-03-05 13:13:00*Eurozone Jan Producer Prices Up 0.8% On Month Vs. 0.5% In Dec, Consensus 0.3%Quick show2025-03-05 13:12:00*Qatar Feb S&P Global PMI 51.0 Vs. 50.2 In JanuaryQuick show2025-03-05 13:12:00*Eurozone Jan PPI Rises 1.8% Annually Vs. 0.1% In Dec, Consensus +1.4%Quick show2025-03-05 12:34:00Euro Rises Against MajorsQuick show2025-03-05 12:32:00*UK Feb Final Services PMI 51.0 Vs. 50.8 In Jan, Flash 51.1Quick show2025-03-05 12:32:00*UK Feb Final Composite Output Index 50.5 Vs. 50.6 In Jan, Flash 50.5Quick show2025-03-05 12:29:00Gold Edges Higher As Dollar Slips On Economic WorriesQuick show2025-03-05 12:17:00Oil Extends Losses On Oversupply FearsQuick show

- 2025-03-05 12:06:00*Italy Q4 GDP Rises 0.6% Y/Y, Flash 0.5%Quick show2025-03-05 12:05:00*Euro Jumps To More Than 4-year High Of 1.5393 Against Canadian DollarQuick show2025-03-05 12:05:00*Italy Q4 GDP Rises 0.1% Q/Q, Flash 0%Quick show2025-03-05 12:04:00*Euro Advances To 5-year High Of 1.8850 Against NZ DollarQuick show2025-03-05 12:03:00*UK Feb Car Registrations Fall 1.0% On Year: SMMTQuick show2025-03-05 12:02:00*Euro Rises To 7-month High Of 1.7039 Against Australian DollarQuick show2025-03-05 12:01:00*Eurozone Feb Final Composite Output Index Steady At 50.2, Flash 50.2Quick show2025-03-05 12:01:00*Uro Jumps To Near 3-week High Of 0.8329 Against PoundQuick show2025-03-05 12:01:00*Eurozone Feb Final Services PMI 50.6 Vs. 51.3 In Jan, Flash 50.7Quick show2025-03-05 12:00:00*Euro Advances To Near 3-week High Of 159.94 Against YenQuick show

- 2025-03-05 11:59:00*Euro Rises To Near 4-month High Of 1.0696 Against U.S. DollarQuick show2025-03-05 11:56:00*Germany Feb Final Services PMI 51.1 Vs. 52.5 In Jan, Flash 52.2Quick show2025-03-05 11:56:00*Germany Feb Final Composite PMI 50.4 Vs. 50.5 In Jan, Flash 51.0Quick show2025-03-05 11:53:00Singapore Retail Sales Rise 4.5%Quick show2025-03-05 11:52:00*France Feb Final Composite Output Index 45.1 Vs. 47.6 In Jan, Flash 44.5Quick show2025-03-05 11:51:00*France Feb Final Services PMI 45.3 Vs. 48.2 In Jan, Flash 44.5Quick show2025-03-05 11:47:00*Italy Feb Services PMI 53.0 Vs. 50.4 In Jan, Consensus 50.9Quick show2025-03-05 11:46:00*New Zealand Feb ANZ Commodity Price Index Up 14.0% On Year Vs. 14.6% In JanuaryQuick show2025-03-05 11:45:00*New Zealand Feb ANZ Commodity Price Index Up 3.0% On Month Vs. 1.8% In JanuaryQuick show2025-03-05 11:41:00*Zambia Feb PMI Unchanged At 50.9, Consensus 49.8 - Stanbic Bank/S&P GlobalQuick show

- 2025-03-05 11:38:00*Kenya Feb PMI 50.6 Vs. 50.5 In Jan, Consensus 50.2 - Stanbic Bank/S&P GlobalQuick show2025-03-05 11:36:00*Kazakhstan Feb Services PMI 50.2 Vs. 51.3 In Jan, Consensus 51.4 - Freedom Holding Corp/S&P GlobalQuick show2025-03-05 11:35:00*Mozambique Feb PMI 50.9 Vs. 47.5 In Jan, Consensus 50.0 - Standard Bank/S&P GlobalQuick show2025-03-05 11:27:00India Services Growth Rebounds In FebruaryQuick show2025-03-05 11:17:00*Spain Feb Composite Output Index 55.1 Vs. 54.0 In JanuaryQuick show2025-03-05 11:16:00*Spain Feb HCOB Services PMI 56.2 Vs. 54.9 In Jan, Consensus 55.4Quick show2025-03-05 11:12:00France Industrial Output Falls UnexpectedlyQuick show2025-03-05 10:56:00China Service Sector Growth Improves In FebruaryQuick show2025-03-05 10:48:00*France Jan Manufacturing Output Falls 0.7% M-o-M Vs. -1.0% In DecemberQuick show2025-03-05 10:47:00*France Jan Industrial Output Drops 0.6% On Month Vs. -0.5% In Dec, Consensus +0.6%Quick show

- 2025-03-05 10:41:00Yen Falls Amid Risk-on MoodQuick show2025-03-05 10:23:00*South Africa Feb S&P Global PMI 49.0 Vs. 47.4 In JanuaryQuick show2025-03-05 10:08:00Australia GDP Growth Tops ExpectationsQuick show2025-03-05 09:37:00South Korea GDP Growth Confirmed At 0.1%Quick show2025-03-05 09:22:00China Keeps Growth Target At "Around 5%" Despite Tariff ThreatsQuick show2025-03-05 09:09:00*Estonia Jan Manufacturing Output Down 5.8% M-o-MQuick show2025-03-05 09:07:00*Estonia Jan Industrial Output Falls 2.5% On Year Vs. -4.4% In DecemberQuick show2025-03-05 09:06:00*Estonia Jan Industrial Output Falls 6.0% On Month Vs. +1.3% In DecemberQuick show2025-03-05 09:03:00*Estonia Jan Manufacturing Output Rises 2.0% Y-o-Y Vs. -2.5% In DecemberQuick show2025-03-05 09:01:00*Russia Feb Services PMI 50.5 Vs. 54.6 In JanuaryQuick show

- 2025-03-05 13:18:00*Lebanon Feb PMI 50.5 Vs. 50.6 In Jan, Consensus 50.9 - S&P Global/Blominvest BankQuick show2025-03-05 13:14:00*Ghana Feb S&P Global PMI 50.5 Vs. 47.9 In Jan, Consensus 50.0Quick show2025-03-05 13:13:00*Eurozone Jan Producer Prices Up 0.8% On Month Vs. 0.5% In Dec, Consensus 0.3%Quick show2025-03-05 13:12:00*Qatar Feb S&P Global PMI 51.0 Vs. 50.2 In JanuaryQuick show2025-03-05 13:12:00*Eurozone Jan PPI Rises 1.8% Annually Vs. 0.1% In Dec, Consensus +1.4%Quick show2025-03-05 12:34:00Euro Rises Against MajorsQuick show2025-03-05 12:32:00*UK Feb Final Services PMI 51.0 Vs. 50.8 In Jan, Flash 51.1Quick show2025-03-05 12:32:00*UK Feb Final Composite Output Index 50.5 Vs. 50.6 In Jan, Flash 50.5Quick show2025-03-05 12:29:00Gold Edges Higher As Dollar Slips On Economic WorriesQuick show2025-03-05 12:17:00Oil Extends Losses On Oversupply FearsQuick show