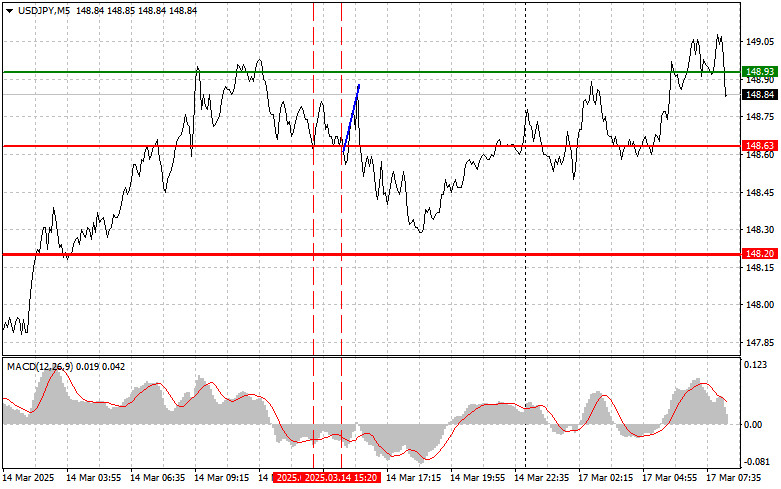

當MACD指數已經從零標記大幅下降時,價格在148.63的測試限制了此貨幣對的下行潛力。因此,我沒有賣出美元。第二次在148.64的測試中,MACD在超賣區,使得買入的方案2得以執行,導致該貨幣對上升了20個點,之後買入美元的需求減少。

市場預期日本央行進一步的加息將限制該貨幣對的上行潛力。投資者積極地將其資本轉向日元,擔心美國可能面臨進一步的經濟問題。此趨勢對日元的價值產生了積極影響,增加了其在全球範圍內的吸引力。交易者推測,日本央行考慮到穩定的通脹跡象,可能會繼續收緊其貨幣政策。進一步的加息可能會驅動資金流入日本,並增強日元的上升趨勢。

對於日內交易策略,我將主要依賴於方案1和方案2。

情境 #1:今天,我計劃在入場點達到大約149.16(圖表上的綠線)時買入USD/JPY,目標是上升至149.92(較粗的綠線)。大約在149.92時,我計劃退出買入倉位並開立賣出交易,預期從此水平有30-35點的下跌。在USD/JPY調整和大幅下跌時最好重新買入該貨幣對。重要!在買入之前,確保MACD指標在零線之上且剛開始上升。

情境 #2:我今天還計劃在148.68水平連續兩次測試時買入USD/JPY,當時MACD指標在超賣區。這將限制該貨幣對的下行潛力,並導致市場逆轉向上。可預期會上升至相反水平的149.16和149.92。

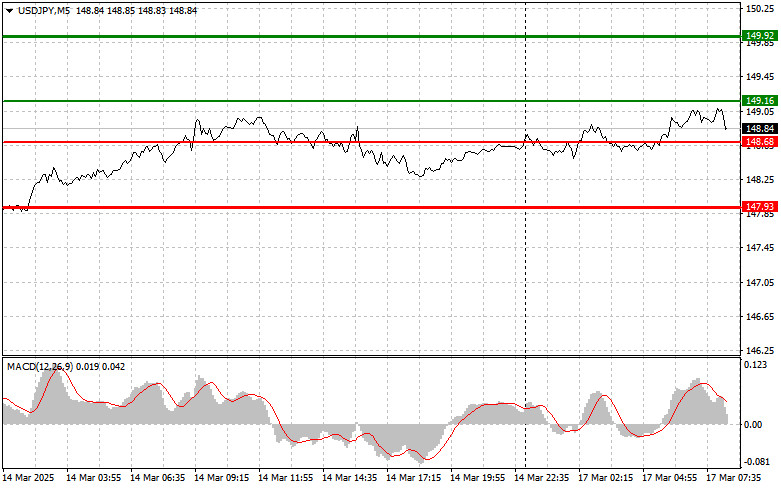

情境 #1:今天,我計劃在USD/JPY跌破148.68(圖表上的紅線)後賣出,這可能會導致貨幣對快速下跌。賣家的關鍵目標是147.93,在此水平我計劃退出賣出倉位並立即開立買入交易,預期從此水平有20-25點的反彈。貨幣對面臨的壓力可能隨時回來。重要!在賣出之前,確保MACD指標在零線之下且剛開始下降。

情境 #2:我今天還計劃在149.16水平連續兩次測試時賣出USD/JPY,當時MACD指標在超買區。這將限制該貨幣對的上行潛力,並導致市場反轉向下。可預期會下跌至相反水平的148.68和147.93。

You have already liked this post today

*这里的市场分析是为了增加您对市场的了解,而不是给出交易的指示。

InstaForex俱乐部

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.