06.03.2025 06:56 PM

06.03.2025 06:56 PM黃金今天吸引賣家,但仍設法維持在 $2,900 關卡上方。

儘管有賣壓,黃金仍保持在 $2,900 之上,因市場情緒轉向風險較高的資產。美國最近對加拿大和墨西哥的關稅讓步提振了市場的風險偏好,導致資金從避險資產如黃金中流出。然而,盤中下跌缺乏強有力的基本面支持,顯示損失可能會受到限制。

投資者仍然擔心特朗普總統的關稅政策,以及全球貿易戰風險上升。這些因素繼續支撐通常被視為避險資產的黃金。此外,預期特朗普的經濟政策可能會減緩美國的增長,促使聯邦儲備局在 2025 年採取更大幅度的降息行動,這也進一步支撐黃金的價格,防止其出現急劇賣壓。

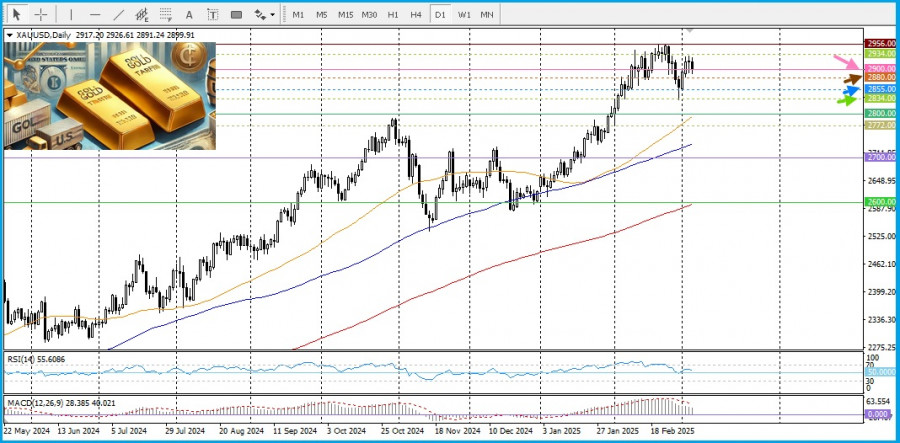

突破 $2,934 水平可能推動金價回到 2 月份創下的 $2,956 的歷史高位。這樣的走勢可能會成為看漲觸發點,鞏固長期上升趨勢,這一趨勢依然維持,並受到日線圖上正向振盪指標的支撐。

然而,缺乏後續買盤,需要在啟動新的多頭頭寸之前保持謹慎。任何修正性回調可被視為在關鍵心理水平 $2,900 附近的買入機會。然而,如果賣壓加劇,更深的下跌可能會瞄準中間支撐位 $2,880,然後是下一個下行水平 $2,855。