#CHPT (ChargePoint Holdings Inc). Exchange rate and online charts.

See Also

- Technical analysis / Video analytics

Forex forecast 21/01/2025: EUR/USD, GBP/USD, USD/CAD, SP500, and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, SP500, and Bitcoin.Author: Sebastian Seliga

12:59 2025-01-21 UTC+2

1768

The current position of the Japanese yen reflects a complex balance between the positive sentiment in equity markets and expectations of interest rate hikes by the Bank of Japan.Author: Irina Yanina

12:37 2025-01-21 UTC+2

1093

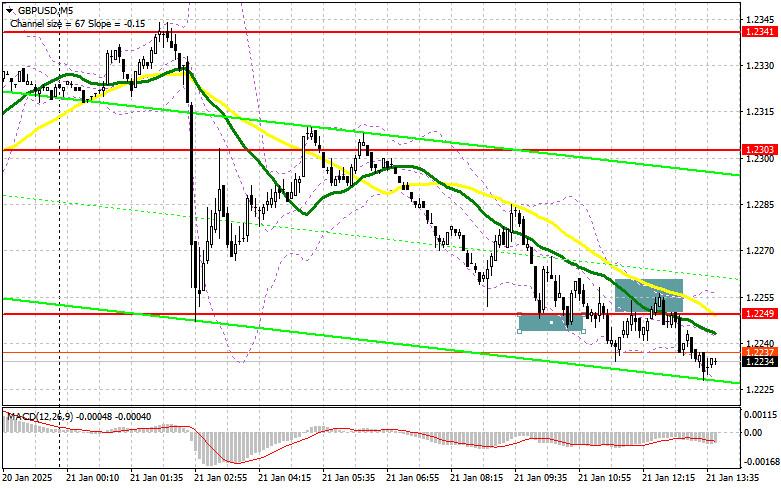

In my morning forecast, I focused on the level of 1.2249 and planned to make trading decisions from thereAuthor: Miroslaw Bawulski

15:34 2025-01-21 UTC+2

1033

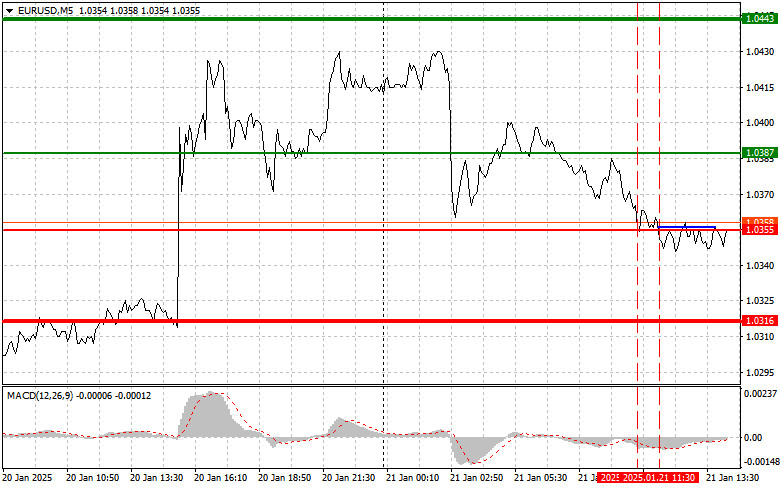

- The test of the 1.0355 price level occurred when the MACD indicator had already dropped significantly below the zero line

Author: Jakub Novak

15:39 2025-01-21 UTC+2

1003

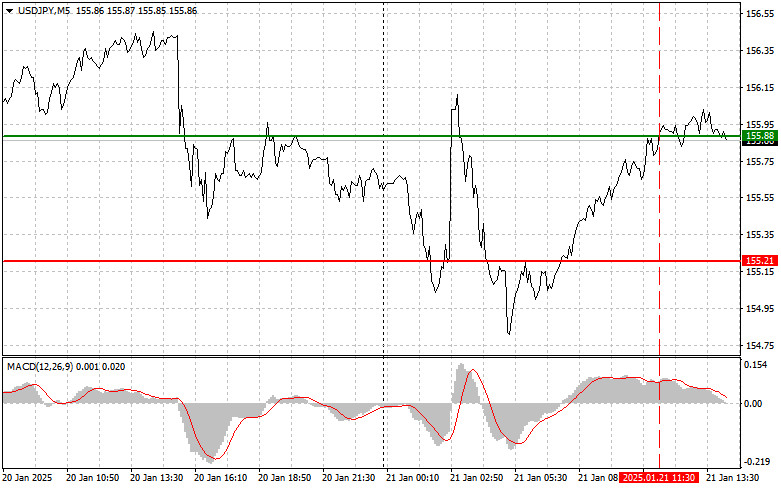

The test of the 155.88 price level occurred when the MACD indicator had already moved significantly above the zero lineAuthor: Jakub Novak

15:47 2025-01-21 UTC+2

1003

Technical analysisTrading Signals for EUR/USD for January 21-25, 2025: buy above 1.0327 (21 SMA - 200 EMA)

In case the Euro falls below the 21 SMA located at 1.0327, the bearish outlook could resume and we could expect a new bearish cycle. So, the Euro could reach 3/8 of Murray located at 1.0131.Author: Dimitrios Zappas

17:59 2025-01-21 UTC+2

988

- Technical analysis

Trading Signals for GOLD for January 21-25, 2025: sell below $2,739 (21 SMA - 6/8 Murray)

On the contrary, if gold consolidates below 6/8 of Murray, we could expect the metal to fall towards the 21 SMA located at 2,712 and finally towards 5/8 of Murray located at 2,695.Author: Dimitrios Zappas

17:57 2025-01-21 UTC+2

958

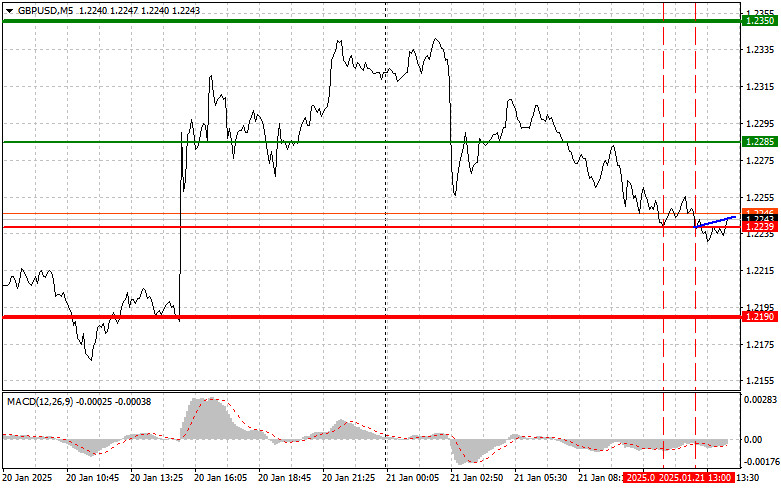

The test of the 1.2239 price level occurred when the MACD indicator had already dropped significantly below the zero lineAuthor: Jakub Novak

15:43 2025-01-21 UTC+2

943

Crypto-currenciesTrading Recommendations for the Cryptocurrency Market on January 21st (U.S. Session)

Bitcoin and Ethereum returned to a gradual upward trend during the first half of the dayAuthor: Miroslaw Bawulski

16:00 2025-01-21 UTC+2

943

- Technical analysis / Video analytics

Forex forecast 21/01/2025: EUR/USD, GBP/USD, USD/CAD, SP500, and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, SP500, and Bitcoin.Author: Sebastian Seliga

12:59 2025-01-21 UTC+2

1768

- The current position of the Japanese yen reflects a complex balance between the positive sentiment in equity markets and expectations of interest rate hikes by the Bank of Japan.

Author: Irina Yanina

12:37 2025-01-21 UTC+2

1093

- In my morning forecast, I focused on the level of 1.2249 and planned to make trading decisions from there

Author: Miroslaw Bawulski

15:34 2025-01-21 UTC+2

1033

- The test of the 1.0355 price level occurred when the MACD indicator had already dropped significantly below the zero line

Author: Jakub Novak

15:39 2025-01-21 UTC+2

1003

- The test of the 155.88 price level occurred when the MACD indicator had already moved significantly above the zero line

Author: Jakub Novak

15:47 2025-01-21 UTC+2

1003

- Technical analysis

Trading Signals for EUR/USD for January 21-25, 2025: buy above 1.0327 (21 SMA - 200 EMA)

In case the Euro falls below the 21 SMA located at 1.0327, the bearish outlook could resume and we could expect a new bearish cycle. So, the Euro could reach 3/8 of Murray located at 1.0131.Author: Dimitrios Zappas

17:59 2025-01-21 UTC+2

988

- Technical analysis

Trading Signals for GOLD for January 21-25, 2025: sell below $2,739 (21 SMA - 6/8 Murray)

On the contrary, if gold consolidates below 6/8 of Murray, we could expect the metal to fall towards the 21 SMA located at 2,712 and finally towards 5/8 of Murray located at 2,695.Author: Dimitrios Zappas

17:57 2025-01-21 UTC+2

958

- The test of the 1.2239 price level occurred when the MACD indicator had already dropped significantly below the zero line

Author: Jakub Novak

15:43 2025-01-21 UTC+2

943

- Crypto-currencies

Trading Recommendations for the Cryptocurrency Market on January 21st (U.S. Session)

Bitcoin and Ethereum returned to a gradual upward trend during the first half of the dayAuthor: Miroslaw Bawulski

16:00 2025-01-21 UTC+2

943