আরও দেখুন

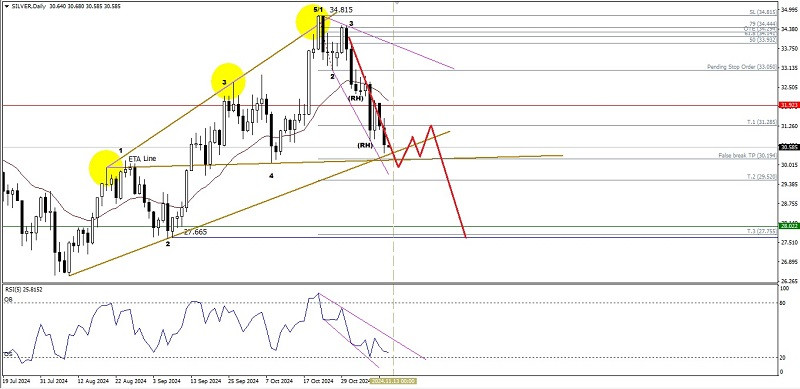

On the daily chart, the Silver commodity asset appears to have an Ascending Broadening Wedge pattern which also indirectly forms a Three Little Indian and Wolf Waves reversal pattern, coupled with the appearance of a Bearish 123 pattern followed by several Bearish Ross Hook (RH) which further strengthens the probability of Silver weakening in the next few days where the level of 30.194 will be tested by this commodity asset if this level, which coincidentally is also the ETA Line level of Wolf Waves, is successfully broken and closes below it, then Silver will continue to weaken to the level of 29.520 and if the momentum and volatility support it, then 28.022 will be the next target to be aimed for, but please note that with the appearance of a Descending Broadening Wedge pattern in its price movement with the RSI indicator (5) which gives an indication of a weakening downward momentum, there is the potential for a reversal that will make Silver strengthen again, but as long as the strengthening does not broken and close above the level of 33.050, Silver will weaken again down towards the target levels that have been described previously.

(Disclaimer)

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।